Gold vs Bonds

May 2 2024

►Fed leaves interest rates unchanged

►Gold vs Bonds

►China in trouble, what does this mean for the gold price?

Fed Leaves Interest Rates Unchanged

Gold vs Bonds

Last week, I mentioned that the bond market, with a market capitalization of $133 trillion, is a major 'competitor' to gold (worth $15.7 trillion). Today, I will delve deeper into this.

Over the past century, the U.S. dollar has distinguished itself as one of the best-performing currencies, only surpassed by the Swiss Franc. Throughout this period, the United States remained the largest economy worldwide, with the dollar as the dominant reserve currency. Despite this, U.S. Treasury bonds have been less profitable than investments in gold.

According to data from Professor Aswath Damodaran, dating back to 1928, an investment of $100 in U.S. Treasury bills/short-term government bonds (T-bills) would have grown to $2,249 by the end of 2023. A riskier investment in long-term government bonds (T-bonds) would have turned the same amount into $7,278. At first glance, this seems impressive, but this growth is mainly attributable to the devaluation of the dollar during that period. However, a similar investment of $100 in gold would have grown to $10,042, significantly more than the bonds.

This difference in performance is further highlighted by the inflation of the money supply; the number of dollars has increased more than 400 times since 1928. Although the amount of gold has also increased — it is estimated that the global stock grows by about 1% to 2% annually — this growth is much slower than that of the money supply. After 95 years, the amount of available gold in the market has approximately quadrupled.

Ready to make the most of these insights? Open an account at GoldRepublic today and start securing your investment in gold.

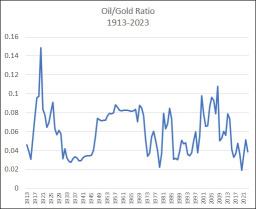

<p>How many ounces of gold can you buy with one barrel of oil? Source: https://www.lynalden.com</p>

China in Trouble

On January 25, I published the newsletter "Investors lose confidence in China," and this confidence appears to be declining further. Chinese regulators are warning of financial instabilities that could be comparable to the collapse of Silicon Valley Bank in the US (March 2023). The Chinese banking sector is being closely monitored to prevent similar issues that led to the downfall - just as happened with Silicon Valley Bank, such as liquidity problems and a rapidly changing interest rate environment, from occurring in China as well. This underscores concerns about potential risks within the financial system and the need for stringent regulation and monitoring. Shortly after Silicon Valley Bank collapsed, the gold price rose by 8% in just 8 days. There was panic due to a possible bank run at other banks.

Disclaimer: The information on this webpage is not considered investment advice or an investment recommendation.