AI bubble?

July 4 2024

►Stock market in an AI bubble? Déjà vu dotcom crash

►Interest Rates: High probability of a rate cut in September 2024

►Gold: priced in different currencies

►App Functionality: Face ID

Stock market in an AI bubble? Déjà vu dotcom crash

The AI fever, coupled with a resilient economy and stronger earnings, has pushed the S&P 500 index to new records this year, rising more than 50% since its October 2022 low. The tech-heavy Nasdaq Composite index has climbed over 70% since the end of 2022. These impressive gains evoke memories of the dotcom era, when technology companies also reached unprecedented valuations.

A select group of giant technology stocks, including AI chipmaker Nvidia, embodies the current market. Nvidia's staggering rise of nearly 4,300% over the past five years is reminiscent of the impressive growth of networking equipment maker Cisco in the 1990s, which saw a similar increase of 4,500%. Although valuations have increased, many of today’s tech champions are in a much stronger financial position than their counterparts from the dotcom era.

The concern is that the AI-driven surge could end in the same way as the dotcom boom, with a massive crash. After nearly quadrupling in just over three years, the Nasdaq Composite plunged almost 80% from its March 2000 peak to October 2002. The S&P 500, which doubled in a similar period, dropped nearly 50% during that time.

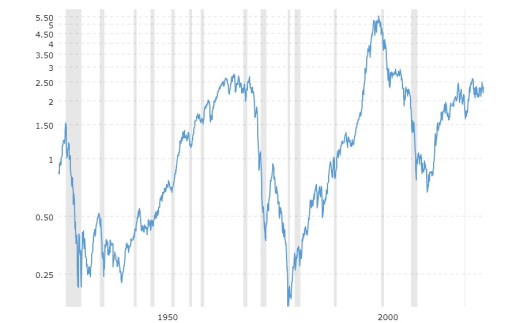

Below is an image of the S&P 500 expressed in gold. In other words, how many ounces of gold are needed to buy the S&P 500? Currently, an ounce of gold costs $2,359 and the S&P 500 stands at $5,537, bringing the ratio to 2.3. This means the ratio is currently above average. Simply put, if you sell the S&P 500 today for 2.3 ounces of gold and this ratio later falls to 1, you could buy back the S&P 500 and have 1.3 ounces of gold left. Ratio traders analyze not only how their assets are priced in currency but also how they are priced relative to other assets they may own.

Source: www.macrotrends.net - How many ounces of gold do you need to buy the S&P 500?

Interest Rates: High probability of a rate cut in September 2024

According to the CME Fed-Watch tool, there is currently a 91.2% chance that the interest rate will remain unchanged at 5.25 - 5.50% on July 31. However, for September 18, there is a greater probability, namely 72.6%, that the rate will be lowered. It is important to understand that these probabilities can change over time due to various macroeconomic factors. One significant example is the inflation figure for June, which will be published next Thursday, July 11. This figure has varied between 3.1 and 3.5% this year, while the FED aims for 2%. If the inflation figure is lower than expected and suggests a cooling of inflation, this could indicate a potential rate cut by the FED. This scenario would be beneficial for your investment in precious metals. Less profitable savings accounts (and bonds) could encourage investors to move towards precious metals (and stocks), which could further drive up prices.

Don't have an account with GoldRepublic to buy gold yet?

Disclaimer: The information on this webpage is not considered investment advice or an investment recommendation.

Gold: priced in different currencies

We are halfway through 2024, time for a mid-year update on the price increase of gold in various currencies. The World Gold Council published the 'Gold Mid-Year Outlook 2024' report this week, which includes a table with these increases. As can be seen, gold has risen the most in JPY (Japanese Yen) and TRY (Turkish Lira). This highlights the unique property of gold: we can view the performance of the same 'product' in different currencies. After all, gold is bought all over the world! But what do the differences in performance in these currencies say? Essentially nothing about gold itself. Gold remains gold and will always be gold. These differences reflect the devaluation of currencies. And that is precisely why gold protects your purchasing power. Do you also want to protect your purchasing power?

App Functionality: Face ID

To make logging in easier, Face ID is now available in the GoldRepublic app. Follow these steps to enable Face ID:

- Log in to the app.

- Open the hamburger menu.

- Go to Security Settings.

- Enable Face ID.

Don't have the GoldRepublic app yet?