Massive Dip! What’s Going On?

August 8 2024

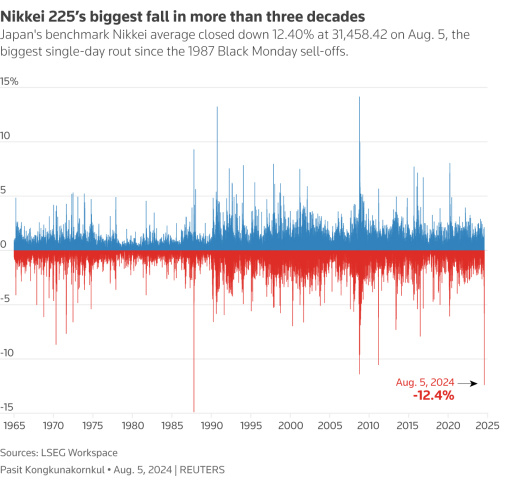

► 'Yen Carry Trade' Causes Massive Dip: Largest Drop Since Black Monday (1987)

►Macroscopic EP. 19 - Part 1/2

'Yen Carry Trade' Causes Massive Dip: Largest Drop Since Black Monday (1987)

Yen Carry Trade

I'll do my best to explain the 'Yen Carry Trade' in simple terms.

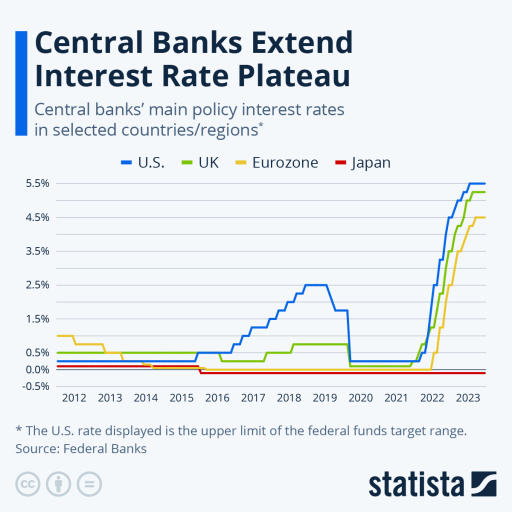

In 2022, central banks worldwide, including in the US, UK, and Europe (see image above), significantly raised interest rates to combat inflation. Higher interest rates encourage people to save more and borrow less, which helps to slow down the economy and curb price increases. However, Japan took a different approach and kept its interest rate around 0% for a long time, even slightly below 0%. It was only in March 2024 that they raised the rate to 0.10%, and then to 0.25% at the end of last week.

Traders took advantage of these low rates in Japan by borrowing cheap Japanese yen (¥), exchanging them for dollars, and investing those dollars in American financial products like tech stocks and bonds that offer higher returns/interest rates. This strategy, where you borrow cheaply in country A and invest in country B with a higher interest rate, is called 'Carry Trade'.

However, something happened last Friday that significantly disrupted this strategy. Economic figures from the US were worse than expected: unemployment rose from 4.1% to 4.3%, and job growth was much lower than anticipated. At the same time, the value of the Japanese yen increased because the Japanese central bank raised interest rates. As a result, the value of the dollar dropped against the yen from ¥160 to ¥140, a decrease of 12.5% (see image below).

For investors who had borrowed ¥160 to invest in dollars, this meant they now needed more dollars to repay their loan. If their investment had also decreased in value, they were hit twice as hard. This led to panic in the market, with traders forced to close their positions. Consequently, almost all major stock markets fell, as well as cryptocurrencies and precious metals, due to fear of further declines.

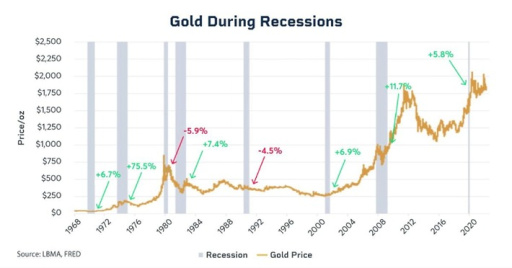

When the unemployment rate rises, a recession is often on the horizon. However, as the image shows, this is not always the case; the economy can still recover. You may be wondering how gold has performed during past recessions. In 6 of the last 8 recessions, gold ended in positive territory. While this does not guarantee the same outcome in future recessions, you can draw your own conclusions from this.

However, precious metals are not entirely 'panic-proof.' During market panic, many investors sell their financial products, which can cause prices to drop. The recent dip in the financial market has not significantly impacted gold so far; gold has only decreased by 1% compared to last weekend's price, and silver by about 4%.

Don't have an account with GoldRepublic to buy gold yet?

Open an account

Disclaimer: The information on this webpage is not considered investment advice or an investment recommendation.