China's Growing Presence in Europe

July 11 2024

►Interest Rate Policy: Cooling Inflation Leads to Rising Precious Metal Prices!

►China: Major Role on the European Stage

►Gold/SIlver Ratio: Opportunity for Silver?

►Macroscopic EP.17

Interest Rate Policy: Cooling Inflation Leads to Rising Precious Metal Prices!

SOURCE: WWW.GOLDREPUBLIC.COM/GOLD-PRICE

China: Major Role on the European Stage

Out of the 13 main sponsors of the 2024 European Championship in Germany, no less than 5 are Chinese companies: BYD, AliExpress, Alipay+, Hisense, and Vivo (in the previous championship there were 3, and in the one before that, only 1). It's notable that German car brands such as Mercedes, Volkswagen, Opel, and BMW are not visible at the championship, while the Chinese car brand BYD has invested tens of millions to stand out in Europe. Just yesterday, 7.8 million Dutch viewers watched the match between the Netherlands and England.

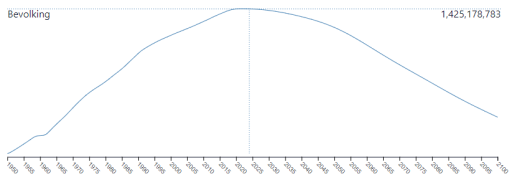

Enough about football. In recent years, China has made a significant shift from being the 'factory of the world' to developing and selling its own brands. Chances are that your phone, car, TV, or laptop is made in China. Or that it’s a Chinese brand. Look around you, more comes from China than you probably think. China has become increasingly important to us and the world in general. I also found it interesting to study China's population pyramid and look at the growth projections for the coming years. It seems that China's population has now reached its peak. This could be a reason why China is economically expanding into other markets, including Europe.

Population of China / source: www.populationpyramid.net

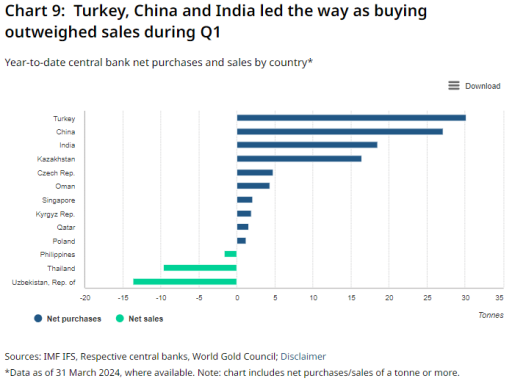

https://www.gold.org/goldhub/research/gold-demand-trends/gold-demand-trends-q1-2024/central-banks

I expect the World Gold Council to soon publish the results for the first half of 2024, and I will keep you informed. Last Sunday, the People’s Bank of China (PBOC) revealed that they did not purchase any gold in both May and June. Before this pause in May 2024, China had been buying gold every month since January 2023. With gold prices fluctuating between $1,800 and $2,000 per troy ounce in 2023, and now standing at $2,381, these purchases have proven to be profitable investments.

Despite China's strong presence in the Western world, there are underlying issues. I previously wrote about a real estate crisis in China. On Monday, July 9th, it was reported that this real estate crisis, and consequently the banking crisis, has worsened.

In just one week, 40 Chinese banks were merged into larger institutions, and on Monday, Jiangxi Bank of China went bankrupt, further escalating the crisis. There are approximately 3,800 troubled institutions with 55 trillion yuan in assets, representing 13% of the total banking system. These institutions have large amounts of bad loans, often to real estate developers and local governments.

The Bank of Jiujiang warned of a 30% profit decline due to poorly performing loans. Chinese authorities are trying to eliminate weak banks through mergers, but this creates larger problematic banks. The real estate sector is in a deep recession, with falling prices and halted projects, putting pressure on the banking sector.

Asset management companies have taken over the bad loans, leading to hidden debts. The new banking regulator, NAFR, has imposed fines and stricter controls. S&P Global expects it will take ten years to restructure the banking sector.

The economic slowdown in China will exacerbate banking problems, likely resulting in massive liquidity injections and stimulus measures by the central bank. Consequently, investors are increasingly turning to stable assets like gold to protect their wealth.

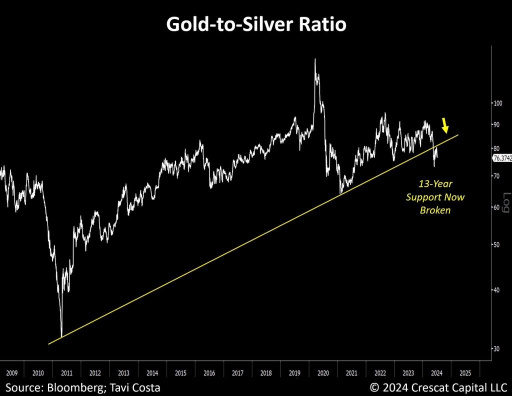

Gold/SIlver Ratio: Opportunity for Silver?

Gold has risen by approximately 18.3% in euros so far this year, while silver has increased by an impressive 34.8%! As a result, the gold/silver ratio has decreased. Will this trend continue? And will the gold/silver ratio decline further? If so, it might be wise to exchange (part of) your gold for silver. Take advantage of a 50% discount on transaction fees for a precious metal swap!

Contact our account managers at +44 (0) 20 3405 1979 or email support@goldrepublic.com.

bloomberg, tavi costa

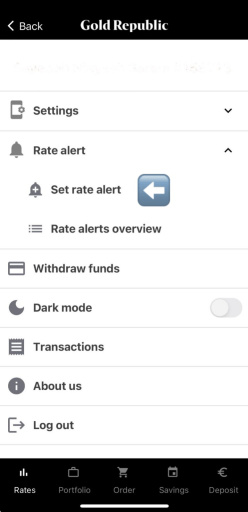

App Functionality: Set up a rate alerts in the GoldRepublic app

- Log in

- Click on the hamburger menu at the top right

- Click on 'Rate alert'

- 'Set rate alert'

You can set up rate alerts to stay informed about precious metal prices!

Don't have the GoldRepublic app yet?

goldrepublic app

Zombie ECONOMIES and DEBT doom loop with James Lavish & David Foley | EP.17

Macroscopic EP.17

Don't have an account with GoldRepublic to buy gold yet?

Disclaimer: The information on this webpage is not considered investment advice or an investment recommendation.