All precious metal prices are up!

May 17 2024

►Macro-economics: Statistics United States

►Gold: Gold remains popular among the Chinese

►Silver: Technical room for the silver price?

►Platinum: Platinum is on a significant rise.

►App Functionality: Face ID

Macro-economics: Statistics United States

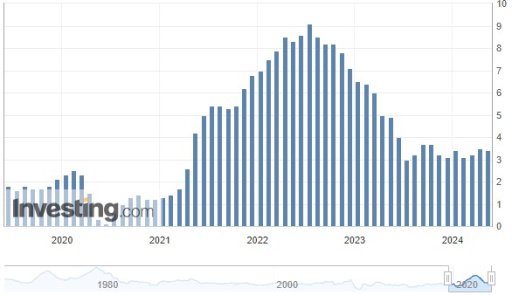

PPI (Producer Price Index) figures May 14: 2.2% YOY (expected: 2.2%)

CPI (Consumer Price Index) figures May 15: 3.4% YOY (expected: 3.4%)

The key figures related to the FED's interest rate policy have been released in recent days. Inflation remains persistent, but the FED chairman has indicated that he expects the strict interest rate policy to take time to work. We look forward to the next interest rate decision on June 12. The current expectation is that the rate will remain unchanged at 5.25-5.50%. The next possible rate cut is scheduled for September 18, with a 72.6% chance according to the CME FedWatch Tool.

Jerome Powell, the chairman of the Federal Reserve, visited Amsterdam for the first time yesterday at the invitation of the Foreign Bankers Association. Investors reacted positively to the expectation that the interest rate will likely not rise further this year, leading to higher precious metal prices, a new high for the NASDAQ, and a surge in the value of Bitcoin.

CPI USA in % (YOY) - source: www.investing.com/economic-calendar/cpi-733

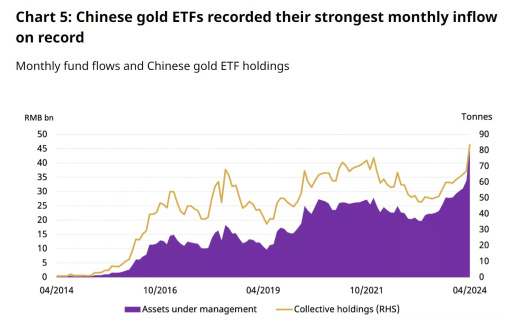

Gold: Gold remains popular among the Chinese

In April, the demand for Chinese gold ETFs exceeded all expectations, with an inflow of 9 billion RMB (US$1.3 billion). This led to a record high total of assets under management, reaching 46 billion RMB (US$6.4 billion) and an increase in holdings by 17 tons to 84 tons. Additionally, Michael Burry, the American hedge fund manager known for predicting the 2008 financial crisis, has added gold to his portfolio. Gold is now his fifth largest position.

source: www.kitco.com

Silver: Technical room for the silver price?

According to technical analysis, silver looks very promising. Otavio Costa, who has also been a guest on Macroscopic, tweeted that there is room for silver to grow. The gold/silver ratio is currently at 80.9, down from 87.6 at the beginning of the month. This indicates that silver has been rising faster than gold this month. Do you expect silver to increase in value more than gold? Are you considering swapping some of your gold for silver? If so, contact our account managers. With such a precious metal swap, you will receive a 50% discount on transaction fees.

Ready to make the most of these insights? Open an account at GoldRepublic today and start securing your investment in gold.

Open Account

Disclaimer: The information on this webpage is not considered investment advice or an investment recommendation.

Platinum: Platinum is on a significant rise.

After reaching a peak of nearly €54,000 per kg in 2008, the price of platinum declined in the following years, hitting a low of €16,000 per kg in 2020. Due to this drop, platinum mining has become increasingly unprofitable (or sometimes even loss-making) for miners, as costs exceed returns. Consequently, several platinum miners have halted or reduced their operations, leading to a shortage in recent years. With high demand and low supply, a price increase is inevitable, and we are seeing that now. Have you invested part of your portfolio in platinum?

App Functionality: Face ID

To make logging in easier, Face ID is now available in the GoldRepublic app.

Follow these steps to enable Face ID:

- Log in to the app.

- Open the hamburger menu.

- Go to Security Settings.

- Enable Face ID.

Don't have the GoldRepublic app yet?