Gold Rush Among Central Banks

June 20 2024

►Gold: Gold Rush Among Central Banks

►2024 Central Bank Gold Reserves Survey

►Inflation falls in the UK: Good news?

Gold: Gold Rush Among Central Banks

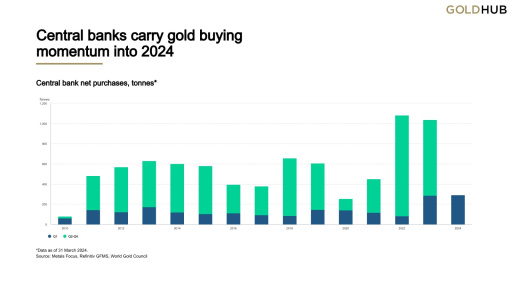

One in six gold owners worldwide is a central bank. Together, these central banks manage 17% of the available above-ground gold, as I also mentioned in my newsletter of April 11th. In the first quarter of 2024, central banks collectively added an impressive 290 tons of gold to their reserves, a record amount for a first quarter. As the second quarter comes to a close, I will share the updated figures with you as soon as they are available.

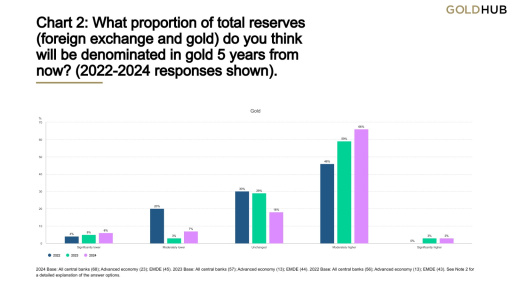

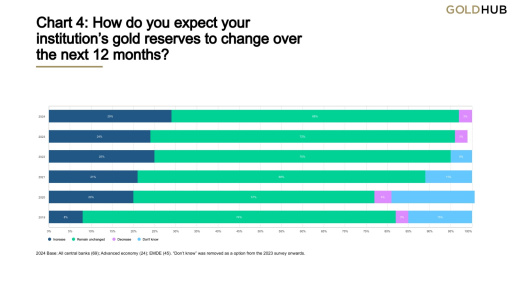

The World Gold Council has published results from the survey - 2024 Central Bank Gold Reserves Survey - which was conducted between February 19 and April 30, 2024, among 70 central banks. I will share my key insights from this report with you.

source: www.gold.org

Conclusion

In the current, increasingly complex geopolitical and financial context, managing gold reserves is becoming ever more essential. In 2023, central banks worldwide purchased 1,037 tons of gold, the second largest annual purchase in history, following a record amount of 1,082 tons in 2022. The latest 'Central Bank Gold Reserves Survey' of 2024 indicates that 29% of central banks plan to increase their gold reserves within the coming year. The primary drivers for these purchases are the need for a more strategic reserve balance and growing concerns about financial stability, such as the risk of economic crises and inflation.

Have you also added gold to your 'reserves'?

Inflation falls in the United Kingdom: Good news?

I recently came across an article on the BBC titled "Inflation falls to lowest level in almost three years," which seems to strike an optimistic note. While a reduction in inflation to the Bank of England's target rate of 2% is certainly noteworthy, it presents a somewhat distorted picture of economic reality. Residents of the United Kingdom are all too aware of the actual cost increases. Here are some examples of how prices of everyday products have risen from January 2020 to May 2024:

- The price of a whole chicken increased by 41.2%, from £4.08 to £5.76.

- A whole loaf of white bread became 31.0% more expensive, rising from £1.03 to £1.35.

- The price for 2 liters of semi-skimmed milk rose by 50.6%, from £0.83 to £1.25.

It is becoming increasingly clear how central banks and governments use their monetary policy tools to influence the economy. For savers, high inflation can be disastrous, especially when the interest rates on savings are lower than the rate of inflation, which is often the case today. On the other hand, high inflation can be advantageous for people or countries with large debts, as the real value of these debts decreases.

Returning to the example of bread prices in the United Kingdom, which have risen by 31% over four years, this increase raises the question of whether wages have also increased by a corresponding percentage. A wage increase of 31% over four years would amount to about 7% per year, a rate that is rarely achieved in practice.

This illustrates that purchasing power in the UK—and globally—is declining. While the bread itself remains the same, its price certainly does not. Four years later, one gets less bread for the same amount of money. Meanwhile, investments in gold and silver have yielded an average of about 9% per year since 2000, outpacing inflation over the past 25 years.

Invest in Gold

SOURCE: office for national services