Red Numbers in the Financial Markets 🔴

July 25 2024

►Financiële markten: Rode cijfers deze week

►Wat betekent dit voor de edelmetaalkoersen?

►Goud: Interessante trend

►GoudKoortsGasten 58: Edin Mujagic

Financial Markets: Red Numbers This Week

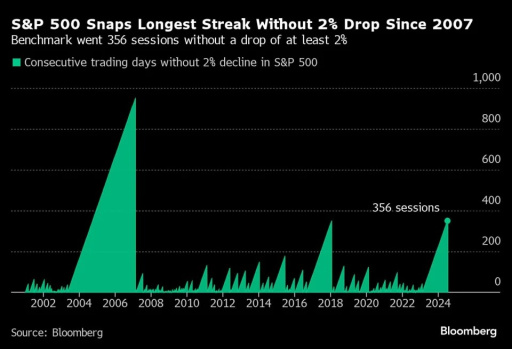

Yesterday marked the end of an impressive streak for the S&P500: the longest period without a daily drop of 2% since 2007. This breakthrough was mainly caused by the disappointing Q2 2024 earnings report from Google.

On July 4th, I already warned that the share of technology companies in the S&P500 has not been this high since the dotcom bubble in 2000 (then 35%, now 32%). Google plays a significant role in this. The recent figures from the world's largest search engine show that massive investments in AI are squeezing short-term profits, resulting in a 5% drop in its share since the publication – the worst day since January this year. The S&P500 dropped by 2.3% yesterday, the deepest daily drop in 18 months.

Tesla also disappointed with their earnings report last Tuesday, contributing to the downward trends in the S&P500 and NASDAQ. We now eagerly await the earnings reports of other major tech companies such as Microsoft, Meta, Apple, and Amazon, which will be published next week. I expect a lot of volatility.

Unfortunately, we will have to wait a bit longer for NVIDIA's results, as they will only report their earnings at the end of August.

source: finance.yahoo.com

What Does This Mean for Precious Metal Prices?

Gold has fallen by 1.1% since the beginning of the week, silver by 5.4%, and platinum by 3.1%. It appears that investors are taking profits (at least for gold), as fundamentally nothing has changed. Market volatility is increasing, as evidenced by the rise in the VIX index. Last week, the VIX index was at 13.92, and now it has surged 35% to 18.80. In theory, a high VIX index typically leads to an increase in gold prices, albeit with some delay.

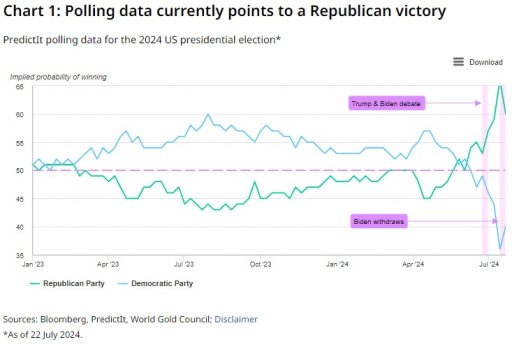

The increased volatility in financial markets is not only due to the earnings reports of tech giants but also to the upcoming U.S. elections. Trump is still leading in the polls, but Vice President Kamala Harris is performing better than Joe Biden and seems to have a greater chance of defeating Trump (see the image below). The outcome of the elections will have a significant impact on the U.S. and global financial markets, explaining the high volatility in the stock markets. In just over three months, on November 5th, we will know who the next president of the U.S. will be.

www.gold.org/goldhub/research/ballots-bullion-examining-us-elections-effect-gold

Gold: An Interesting Trend

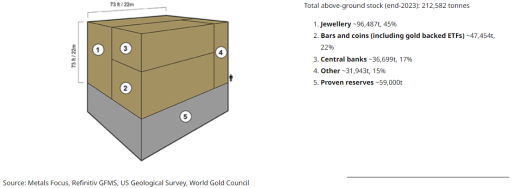

The well-known gold cube is back, but this time we're focusing not on its dimensions but on the distribution of all above-ground gold. Over the years, the percentages have undergone interesting changes. Below is a table with the percentages of above-ground gold usage in 2016 and 2024:

|

Category |

2016 |

2024 |

Difference (%-point) |

|

Jewelry |

60% |

45% |

-15% |

|

Bars & Coins |

20% |

22% |

+2% |

|

Central Banks |

10% |

17% |

+7% |

|

Other |

10% |

15% |

+5% |

In eight years, the percentage of gold used for jewelry has decreased by 15 percentage points. At the same time, the share for bars and coins has increased by 2 percentage points and for central banks by 7 percentage points, nearly doubling compared to 2016.

The trend I observe is that people are increasingly buying gold as an investment or a store of value (like central banks) rather than for jewelry. This shift can partly be attributed to the rising gold price, which makes gold jewelry less accessible to a broader audience. On the other hand, private investors, central banks, and institutional parties are increasingly recognizing the value and strength of gold as a stable investment.

At GoldRepublic, you don't buy gold because it's beautiful; you buy it because it's a proven stable investment that preserves your purchasing power (as currencies lose value). You purchase this ancient product as insurance and to strengthen your financial resilience through diversification.

Where will we be in a few years? If the jewelry category no longer ranks at the top, you will hear it from me first. But I believe you will recognize this trend yourself over the years.

www.gold.org/goldhub/data/how-much-gold

App Functionality: Savings plan

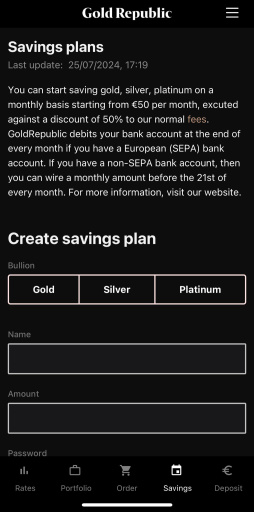

Do you want to build passive wealth using the Dollar-Cost-Averaging (DCA) strategy? Consider opening a savings plan. This can be easily done through the GoldRepublic app!

1. Open the app

2. Click on 'Savings'

3. Create a savingsplan

Don't have the app yet?

goldrepublic app