€900 - highest silver price since 2011!

April 18 2024

►Discover why silver hit a new high

►2024 Outlook: Silver Institute

►Investment Opportunities: Platinum

BREAKING NEWS

Silver Price Increase: India Plays a Key Role

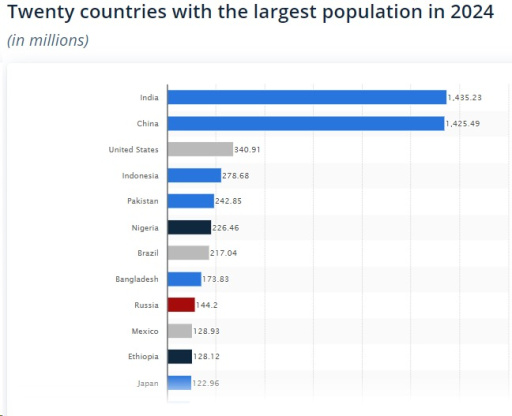

<p>Source: www.statista.com</p>

Last week, I briefly discussed silver, noting that India has significantly increased its silver imports. Today, we will focus specifically on this country, which recently became the world's most populous nation with 1.4 billion residents.

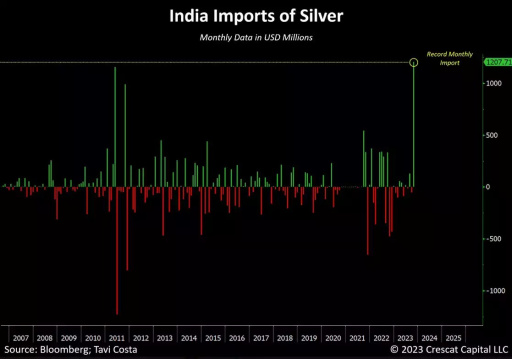

As previously mentioned, last Friday (April 12), silver reached a record high since September 2011 of €900 per kilo. In India, where transactions are made in Indian rupees, silver has even hit its highest rate ever when expressed in their local currency. See the image below.

Invest in Silver

In February 2024, India imported an impressive amount of over 2.2 million ounces of silver, a significant increase of 260% from the 600,000 ounces in January. Of this amount, 900,000 ounces were directly imported from the United Arab Emirates, partly thanks to reduced import duties. For comparison, throughout 2023, India imported 3.6 million ounces of silver, with nearly half of that volume already reached in just two months this year. But what is driving this huge demand? Particularly, the strong need from the manufacturing and solar energy sectors plays a role. Moreover, more and more Indians are buying silver for use in jewelry and as an investment. This trend is undoubtedly a major factor behind the recent price increases of silver. The growth in demand is primarily driven by the manufacturing and solar energy sectors, which are expanding rapidly in India.

Source: Bloomberg, tavi costa

Silver Institute Outlook

The Silver Institute recently published the World Silver Survey 2024, which included an outlook for 2024. Here is an excerpt:

Despite ongoing high inflation and strong economic data, investor interest in silver improved from March 2024. This was partly driven by optimism about an upcoming cycle of interest rate cuts, confirmed by the Fed after its March meeting. New record highs in gold prices and a resurgence in base metal prices also stimulated interest in silver. We expect the Fed to implement three interest rate cuts of 25 basis points each this year, starting mid-year, which would be favorable for investments in precious metals in the second half of 2024. Even with the recent pullback, a still high gold-to-silver ratio will also attract some investors who view silver as undervalued in the long term, perhaps also because its strong fundamentals are gaining attention.

Disclaimer: The information on this webpage is not considered investment advice or an investment recommendation.

Attention ratio traders!

We've discussed the gold/silver ratio several times before, and we can no longer ignore it. This ratio, which stood at 90 on March 1st, has now dropped to 84. Many ratio traders show little interest in how financial products relate to currencies. Instead, they prefer to compare direct assets to each other to determine whether one asset is undervalued or overvalued relative to another.

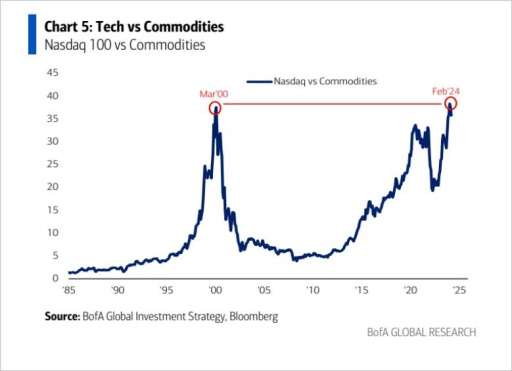

Let's now take a look at how the Nasdaq 100, an American stock index primarily composed of technology companies (excluding financial institutions like banks), compares to commodities.

We continue with a look at what is often considered the 'bad boy' of the class, namely Platinum. You will see that the price of platinum YTD shows a decrease of 5.93% (in dollars), and in euros 1.8%. While other precious metals like gold and silver shine, platinum lags behind.

source: www.investing.com/commodities/metals

Let's explore the potential of platinum

But why should you consider adding platinum to your portfolio? Here are some key points briefly summarized:

1. Platinum is 20 times rarer than gold.

2. The platinum price is still about 60% off its all-time high.

3. Until 2014, platinum was more expensive than gold.

4. The gold/platinum ratio is at a historical high of 2.52.

Platinum has a melting point of 1,768 °C, which is much higher than that of gold (1,064 °C) and silver (961 °C). This property makes platinum very valuable for industrial applications, such as in catalysts for diesel cars. Platinum is also used in the medical sector, for example in cancer treatment and in hearing aids.

Additionally, Swiss watchmakers value platinum for its indestructible qualities, which lend a prestigious image to their watches.

Set up a rate alerts in the GoldRepublic app

Never miss anything again?

Set up a rate alerts in the GoldRepublic app

1. Log in

2. Click on the hamburger menu at the top right

3. Click on 'rate alert'

4. 'Set rate alert'

You can set up rate alerts to stay informed about precious metal prices!