Tariffs up to 104%! China strikes back, gold rockets!

April 10 2025

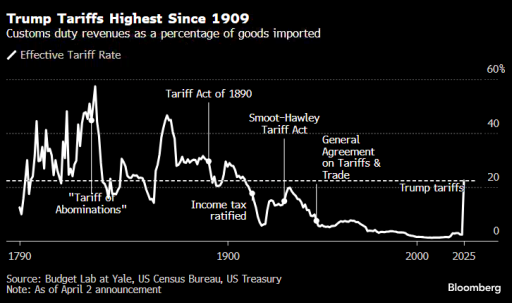

Trump further steps up trade war with record-high import tariffs of up to 104% on Chinese goods; China responds with retaliatory measures

Financial markets under pressure: global equities down, interest rates unexpectedly up sharply on inflation fears.

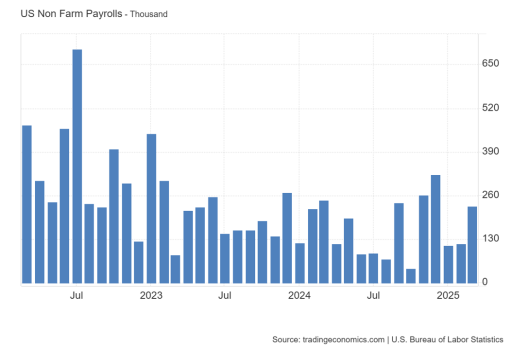

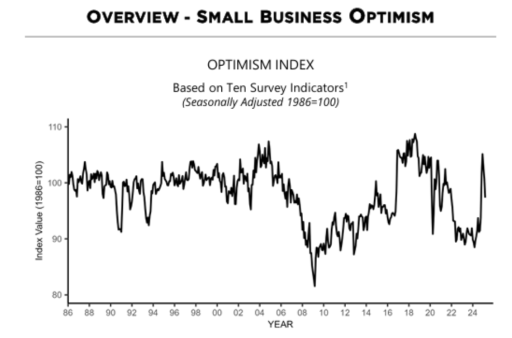

US economy sends mixed signals: strong job growth, but falling business confidence and delayed investment.

Gold makes strong comeback after brief correction, rising 3.5% on rising geopolitical and monetary risks.

Trade war further escalated

President Trump's introduction of so-called reciprocal tariffs has sharply increased economic tensions worldwide. After the previously imposed base tariffs of 10%, higher levies seemed to come into force for over 60 countries, including China, Japan and the European Union. China was hit particularly hard: on some Chinese goods, the targeted tariffs ran as high as 104%. Beijing responded almost immediately with retaliatory measures. From 10 April, import tariffs on US products will be increased from 34% to 84%.

But Trump would not be Trump if he did not immediately leave room for changes in course. And so he came up with the announcement of a 90-day pause in the introduction of new tariffs. However it is still too early to assume structural calm. Experience now shows that within days, or even hours, policy can pivot again. The relief rally in the stock market was powerful then, but also still looks fragile.

The impact of the trade war and the uncertainty surrounding it is not only economic, but also political. The targeted tariffs are the highest in over a century and could put pressure on the global trading system, according to some analysts. This also raises the question of whether countries like China are still willing to continue buying US government bonds, a vital source of funding for the US government. At the same time, there are growing fears of a possible currency war, with countries deliberately weakening their currencies to compensate for export losses.

Markets under pressure, interest rates rise against trend

Financial markets reacted violently to the new escalation. Equity indices worldwide plunged sharply ahead of Trump's postponement, with technology and industrial sectors in particular taking hits. At the same time, long-term interest rates rose sharply. US 30-year yields briefly broke through the 5% barrier and interest rates in the UK also rose to their highest level since 1998.

Normally, interest rates fall when there is economic uncertainty, but this time the cause of uncertainty, namely the prospect of higher prices due to tariffs, is also a source of inflation. As a result, investors are not now resorting to bonds as a safe haven.

US economy: mixed signals

Despite the turbulence in the markets, economic news also came out of the US. The number of new jobs in March came in well above expectations at 228,000. Normally this would create a positive mood, but the figure was overshadowed by concerns about the economic impact of tariffs.

Gold rebounds after correction

In the first days after the rate escalation, gold also had to give ground. As often happens in panic phases, liquidity dried up, and investors operating with borrowed money had to sell positions, even in traditionally safe assets.

That correction was short-lived. Meanwhile, gold has recovered strongly. On Thursday, gold prices recorded a 3.5% rise, the strongest daily move in months. The combination of geopolitical uncertainty, looming recession and declining confidence in traditional currencies is again fuelling demand for gold as a protection against systemic risks.