Trump is back: What does this mean for gold and financial markets?

January 23 2025

- Trump's second term begins: What does it mean for financial markets?

- Euro rises: Trade risks look lower for Europe for now

- US stocks near record high: New AI investment boosts confidence.

- Dutch housing market: First signs of cooling visible.

Donald Trump's inauguration as 47th president

This week was all about Donald Trump's inauguration as the 47th president of the United States. Although there were high hopes for his first pronouncements during his second term, the reaction in financial markets remained relatively limited.

Euro rises despite Trump's plans

The most notable movement in the markets was the rise in the euro, which appreciated by about 2% against the US dollar. This was because Trump, despite his earlier statements about tough import tariffs, paid little attention to Europe in his first few days. This made the trade risk for European countries seem lower for now, which strengthened the euro.

For Bitcoin investors, there were hopes that Trump would say something directly about the possible plan to establish Bitcoin as a strategic reserve for the United States. However, this message fell short, as Trump focused mainly on broader ambitions to make the US an undisputed world leader again.

After a short period of considerable movement, the price of Bitcoin eventually remained almost unchanged from before the inauguration.

US equities heading for record highs

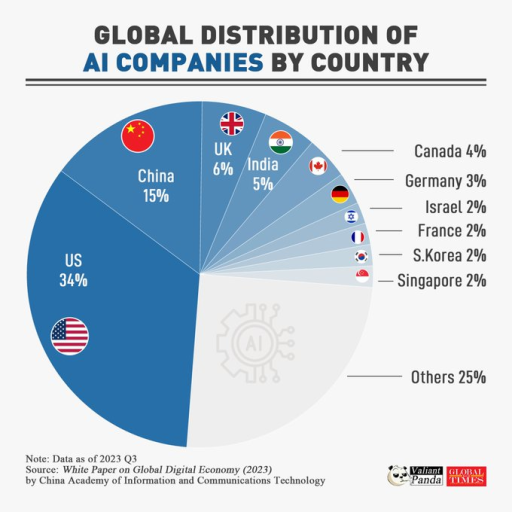

US equity markets reacted positively to the inauguration. After a quiet start, prices almost reached an all-time high. A key driver was Trump's announcement to partner with major technology companies to invest more than $500 billion in A.I. infrastructure. These plans also included the creation of more than 100,000 jobs, further boosting confidence in the US economy.

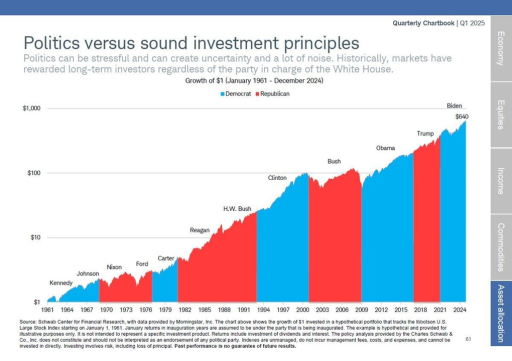

The chart above shows that the influence of the US president on stock markets is often overestimated. Historically, stock prices rise on average regardless of who or which party is in power.

Europe's reaction: restraint

There was limited reaction from Europe to Trump's inauguration. European leaders stressed that Europe should stay its own course and that regulation of large US technology companies should continue. Other than that, things remained quiet, possibly because Trump seems to be paying little attention to Europe for the time being.

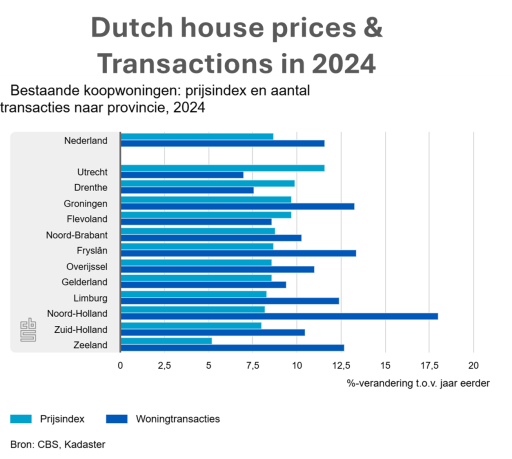

Netherlands: cooling housing market

In the Netherlands, Centraal Bureau voor de Statistiek (CBS) reported that the average price of owner-occupied houses in 2024 was almost 9% higher than a year earlier. Interestingly, however, prices fell 0.7% in December compared to November. This was the first monthly price drop since April 2023 and may be a sign that the Dutch housing market is starting to cool down.

China: Yuan responds to rumours

The Chinese yuan initially appreciated against the US dollar because Trump did not mention any specific measures against China in his initial statements. But when rumours later surfaced that Trump is still considering introducing additional 10% import duties on Chinese goods, the Chinese currency lost ground again.

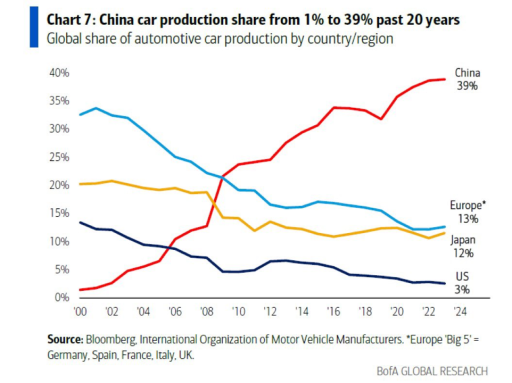

Focus on the auto industry

The auto industry came back into the spotlight as Trump indicated during his inauguration speech that he was aiming for a stronger US auto industry. An interesting chart shows how the US market share in the auto industry has dropped significantly in recent years, while China now dominates the global auto market. This highlights the major challenge facing the US auto industry, a sector that Trump is keen to revitalise.