Inflation Erodes Your Savings – Gold Is the Solution!

January 16 2025

- US interest rates rise: The 10-year rate reaches its highest level since last year, affecting financial markets.

- US labour market remains strong: New jobs and rising wages create inflationary pressure.

- Inflation figures: Inflation remains high in the Netherlands, while core US inflation falls slightly.

- German economy shrinks: Political uncertainty and high energy prices hit Europe's largest economy.

- Geopolitical tensions: Heightened friction between the US and China affects trade and technology.

Stock markets remain dependent on US interest rates

Like last week, stock market sentiment was largely driven by US interest rates, which have risen sharply in recent months. This comes as investors expect the Federal Reserve - the US central bank - to have little room to cut policy rates further. Interest rates remain a key focus for markets.

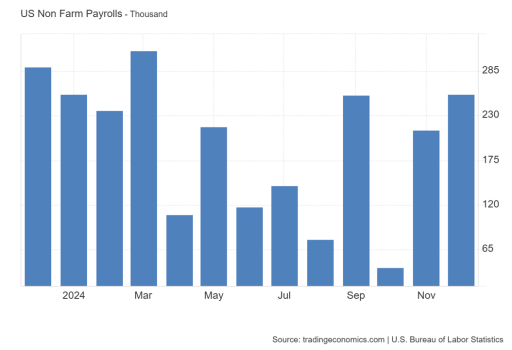

Jobs figures: labour market strength

Last Friday, it was announced that the US economy created 256,000 new jobs in December, almost 100,000 more than economists had expected. This reaffirms that the US labour market remains very tight. A tight labour market means that unemployment is low and companies are struggling to find suitable workers. This allows workers to demand higher wages, which in turn can further fuel inflation.

Higher interest rates do not fit well with the policies that incoming President Donald Trump is likely to pursue. During his previous presidency, Trump regularly criticised the Federal Reserve's interest rate policy, which he said hindered economic growth by keeping interest rates too high.

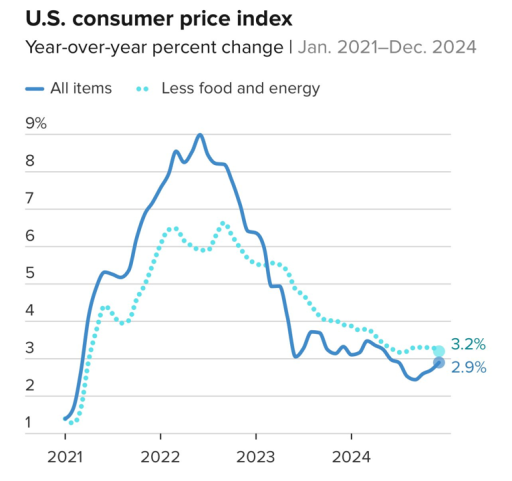

Inflation figures: finally a windfall

But on Wednesday, inflation figures for December were released. Although overall inflation rose to 2.9% - the highest level since July last year - core inflation (excluding food and energy) fell to 3.2%. This was 0.1% lower than expected and caused some optimism among investors.

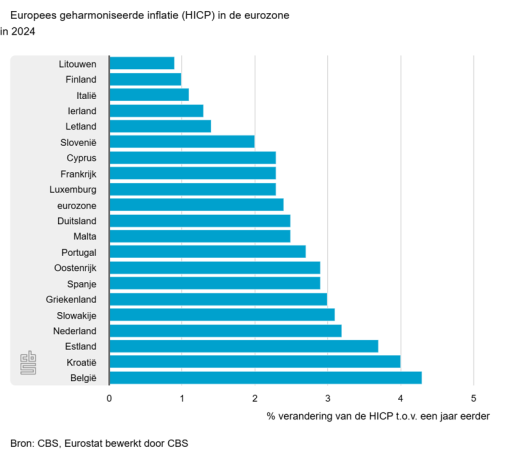

Inflation in the Netherlands remains high

In the Netherlands, inflation also remains a major concern. Prices rose 4.1% year-on-year in December, and total inflation over 2024 came in at 3.3%. This is well above the European Central Bank (ECB) target and is also higher than the Eurozone average. Interestingly, some media reports suggest that inflation is not that bad, which is at odds with the official figures.

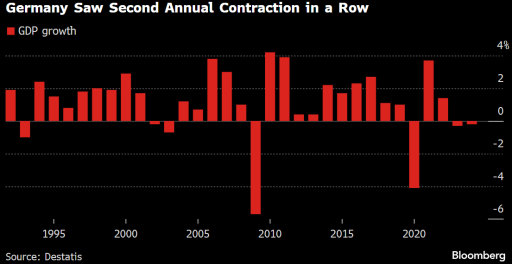

German economy: new elections and contraction

In Germany, political parties are preparing for new elections, with a shift in the balance of power looking likely. At the same time, Germany's national statistics office announced that the German economy contracted for the second consecutive year. This is only the second time since 1950 that this has happened.

The new German government faces a huge challenge to revive the economy, which has been the engine of Europe for years. With a weakened industry and high energy prices, this will not be an easy task.

Geopolitical tensions: China and the US

Even before Donald Trump officially moves into the White House, tensions between the United States and China are rising further. In response to tighter trade restrictions under the Biden administration, China warned that the relationship between the two countries is deteriorating further.

The Netherlands is also playing a role in these tensions by responding to US pressure to limit ASML's exports of advanced technology to China. ASML, a leading company in the production of chip machines, gets a large part of its sales from China. At the same time, the battle over intellectual property is intensifying, further fuelling tensions between the US and China. Moreover, the additional import tariffs that Trump wants to introduce are also a new point of friction.