Gold versus savings: Which choice is smarter in 2025?

January 2 2025

Although macroeconomic and stock market news usually dries up in the last week of the year, there are some notable trends and developments worth mentioning.

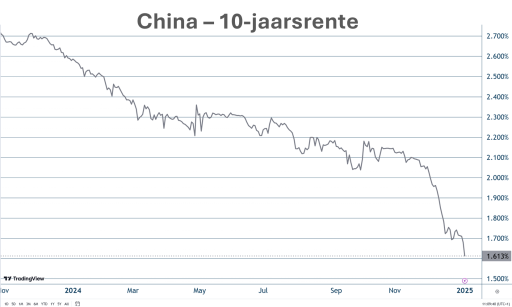

China: Low interest rates and economic malaise

Interest rates in China fell further to 1.60% this week, a huge drop compared to October's 2.20%. This trend underlines the continued weakness of the Chinese economy. The problems in the housing market, where prices have been falling for years, have a direct impact on consumers. With less confidence in their financial future, households are spending less, which is reflected in the very slow growth of consumption.

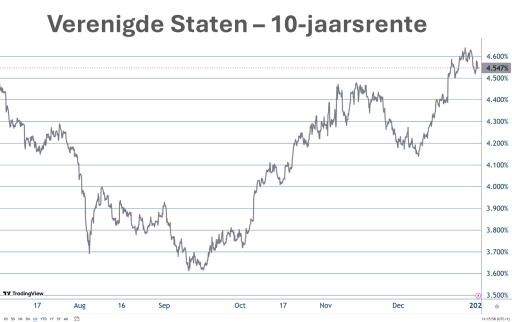

United States: Rising interest rates despite cuts

In the US, we see a striking trend: despite Federal Reserve rate cuts, 10-year yields are rising again. This is driven by two factors:

Healthy economic growth, supporting demand for capital.

Rising inflation risks, leading investors to demand higher yields to offset this risk.

Rising interest rates point to a tension between economic growth and inflation control, a challenge the Fed will have to monitor closely in 2025.

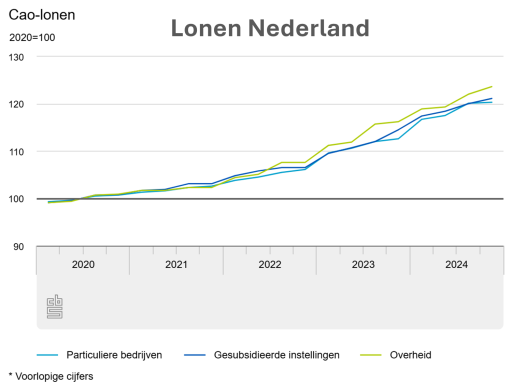

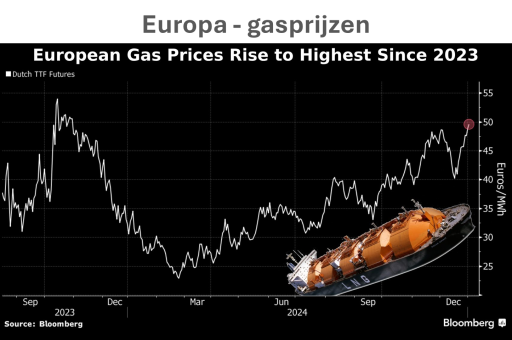

Netherlands: Rising wages and energy prices

In the Netherlands, 2024 was a year of unprecedented wage growth, with the strongest increase since 1982. This was driven by a tight labour market and inflation rising to 4.0% in November. These developments increase the risk of a wage-price spiral, with higher wages pushing up prices further, which in turn leads to higher wages, and so on.

With rising inflation and rising costs, the real value of savings (adjusted for inflation) is rapidly diminishing. This is again forcing savers to seek alternatives to protect their purchasing power. This trend, already evident in 2024, is expected to continue in 2025.

An important way out for investors remains gold, which rose sharply in value in 2024. At the start of the new year, gold remains attractive as a protection against inflation and economic uncertainties.