Gold as a tower of strength amid market chaos?

January 9 2025

-US 10-year rates peak: Highest level since April last year and the impact on markets

-Gold rises despite interest rate hikes: Why investors continue to see gold as a safe haven.

-Dutch inflation remains high: How households struggle with purchasing power loss.

-Euro under pressure: Deteriorating exchange rate due to economic policies in the Eurozone.

US 10-year interest rate rises sharply

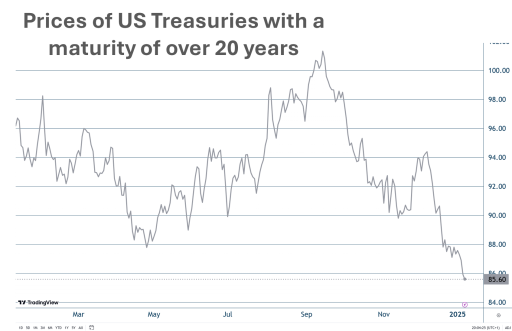

Last week, the news revolved mainly around one important figure: the US 10-year interest rate. This is the interest rate investors get when they borrow money from the US government for 10 years. This interest rate rose more than 1 percentage point to almost 4.70%, the highest level since April last year.

Why are interest rates rising?

Interest rates are rising because investors are increasingly worried about inflation. In recent months, inflation in the US ran up from 2.4% to 2.7%. So this means that stuff and services became 2.7% more expensive on average compared to a year ago.

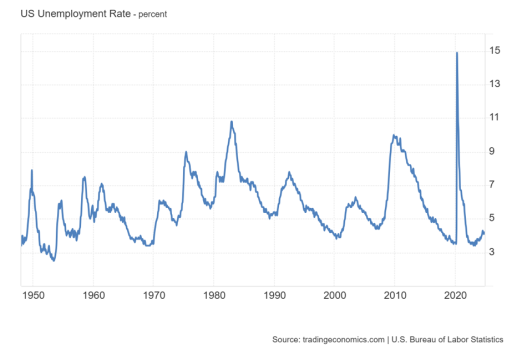

Moreover, new figures came out this week showing additional inflationary pressures. The US labour market is still strong. That means workers are in high demand, which means they can demand higher wages. At the same time, companies in the service sector (think hospitality, transport, or healthcare) face higher costs. They try to pass these on to customers, which can raise prices further.

Under pressure

As a result of rising interest rates, financial markets are under pressure. Many investors had expected the US central bank, the Federal Reserve (Fed), to cut interest rates further. But disappointing figures on inflation and the economy suggest the Fed will stop cutting interest rates for now.

This affected markets. Prices of bonds, equities and also Bitcoin went down, as investors are less optimistic the prospect of lower interest rates.

Gold remains popular

One notable exception was gold, whose price actually rose. This highlights gold's appeal as a safe haven in times of inflation worries. Often, gold prices fall when interest rates rise, as investors then earn more from other investments.

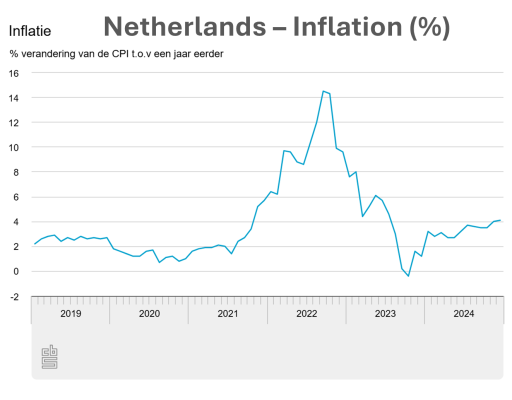

Inflation in the Netherlands: high

In the Netherlands, inflation is even higher than in the US, at 4.1%. Over the whole of 2024, inflation in the Netherlands came to 3.3%, much higher than the European Central Bank's (ECB) target of 2%.

Inflation in the Netherlands is also above the Eurozone average, where prices in December were 2.4% higher than the previous year. This higher inflation makes it harder for households and businesses to maintain their purchasing power.

What is the ECB doing?

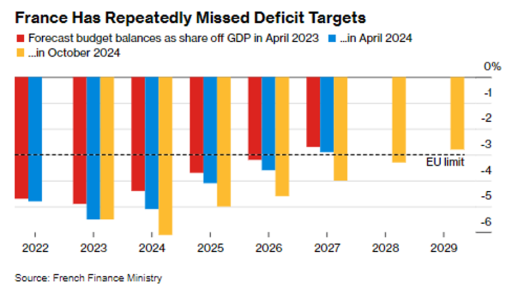

The ECB is keeping open the possibility of interest rate cuts. This means that the ECB is willing to cut interest rates if necessary to stimulate the economy. This flexibility is necessary as German industry is struggling and France is facing major fiscal problems.

The governor of France's central bank warned this week that France's public finances are suffering from a chronic disease. This means that France has been spending more than it takes in for years, causing a growing national debt.

Euro loses ground

The difference in economic policies between the US and the Eurozone is causing the euro to depreciate against the dollar. This means you can buy fewer dollars with a euro. The rate of 1 dollar per 1 euro, or parity, is getting closer.