Trump puts markets on edge: gold rises to record highs

February 6 2025

Trump's trade policies increase market uncertainty - Import tariffs against China, Canada and Mexico create volatility in financial markets.

Federal Reserve keeps interest rates unchanged - Uncertainty over inflation and trade wars complicates further interest rate cuts.

Gold at record high - Geopolitical tensions and inflation concerns further drive demand for precious metals.

Dutch inflation falls, but remains too high - Despite a slight decline in January, purchasing power remains under pressure.

President Trump drives volatility in financial markets

As Donald Trump and his team have started drafting and implementing executive orders, volatility (sharp swings) in markets is increasing. Investors are reacting with increasing sensitivity to his policies, especially on import tariffs.

Import tariffs hit currency and stock markets

Trump had previously announced that he would introduce import tariffs, but this week they would become effective. Canada, China and Mexico were first up. While this was no surprise, markets still reacted violently when it became clear that the tariffs would take effect on 1 February.

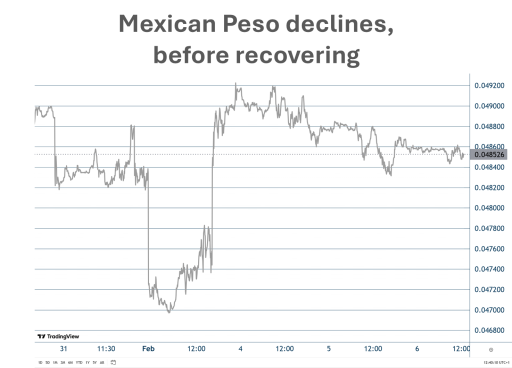

The Mexican peso and the Canadian dollar lost significant value.

Equity markets also came under pressure, especially among companies dependent on international trade.

However, Trump soon showed that he was also using these levies as a negotiating tool. When first Mexico and later Canada introduced stricter border controls, Trump immediately delayed the introduction of the tariffs by at least a month.

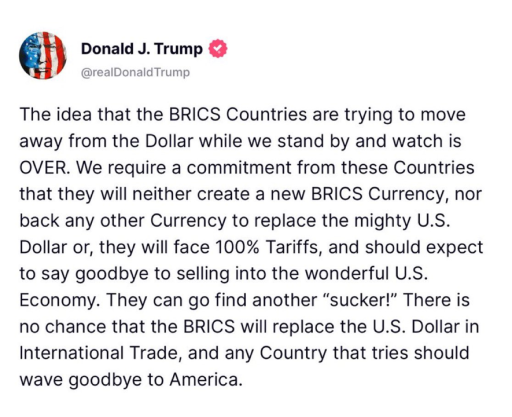

Threats to countries that want to be less dependent on the dollar

The unpredictability of Trump's trade policy was further highlighted by a threat towards countries that want to get rid of the US dollar as an international trade currency. Trump warned that such countries can expect import tariffs of up to 100%.

The focus here is mainly on China and India, which have long been working on alternatives to the US dollar in international trade. These threats increase tensions in global trade and make it more difficult to assess the economic outlook.

Federal Reserve: interest rates remain flat, uncertainty increases

The Federal Reserve (Fed), as expected, has paused in the process of rate cuts. Fed chairman Jerome Powell did, however, indicate that there may be room to cut interest rates further later.

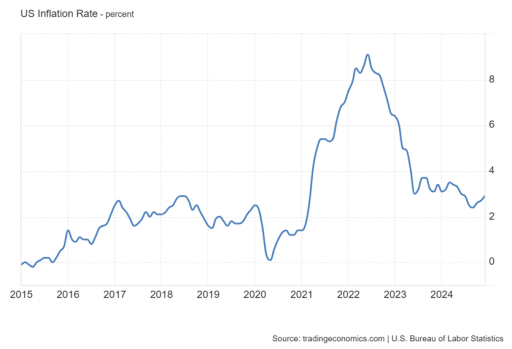

Uncertainty about the effects of Trump's trade wars on inflation makes it difficult for the Fed to make big decisions.

A notable detail was that new Treasury Secretary Scott Bessent stated that Trump does not intend to pressure Powell to cut interest rates. Instead, market interest rates should fall naturally. The Trump administration wants to achieve this through non-inflationary growth - economic growth without rising prices. Investors reacted positively to this, as it signalled that Trump will be less aggressive on the Fed than previously feared.

Gold benefits from increased uncertainty

The big winner from the increased volatility in the markets is gold. Several factors caused gold prices to reach another record high:

- Geopolitical tensions are rising.

- Import tariffs could fuel inflation.

- More and more countries are looking for alternatives to the US dollar.

US business confidence rises, but uncertainty remains

New macro data show that US business confidence rose above 50 in January for the first time since October 2022. This is an important threshold:

A score above 50 means economic growth.

A score below 50 indicates economic contraction.

However, it is unclear whether this figure truly reflects the true economic trend, given the recent uncertainties surrounding trade policy and volatility in the markets.

Netherlands: inflation falls, but remains too high

In the Netherlands, inflation fell sharply in January compared to December.