Trump's trade policy is creating more market uncertainty and putting pressure on the Fed

February 13 2025

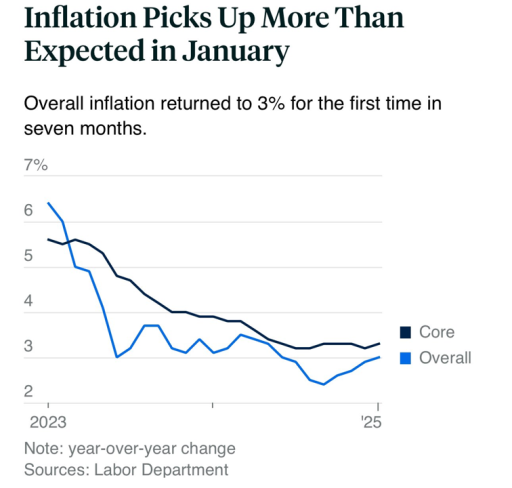

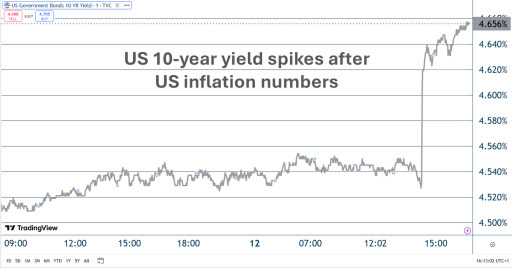

U.S. Inflation Rises Again: Inflation reaches 3.0%, core inflation at 3.3% – Fed delays rate cuts.

Gold in the Spotlight: Rising inflation and geopolitical uncertainty make gold increasingly attractive as a safe haven.

EU Falling Behind in the AI Race: Bureaucracy and regulations hinder investments, while the U.S. continues to accelerate.

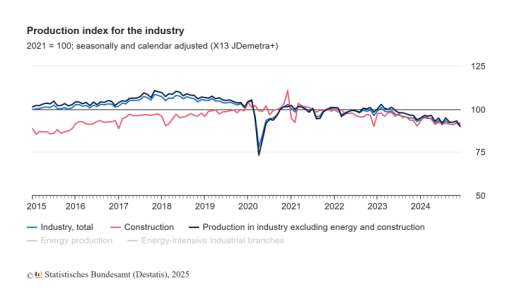

German and Dutch Economies Under Pressure: Weak production figures and political instability weaken competitiveness.

U.S. Inflation Rises Again

This week, it was announced that U.S. inflation increased again in January. The overall inflation rate reached 3.0%, marking the first time in six months that price increases have exceeded 2%.

Core inflation – which excludes the volatile prices of energy and food – came in even higher at 3.3%. Both figures are moving further away from the Federal Reserve’s target.

Fed Chair Jerome Powell had already responded to inflation by postponing further interest rate cuts for the time being.

Fed in a Difficult Position Due to Trump’s Trade Policy

In addition to higher inflation, President Trump's import tariffs are making the Federal Reserve's job even more challenging. Trump frequently announces new tariffs but sometimes delays their implementation.

This unpredictability makes it difficult for the Fed to assess future inflation. It therefore appears that the central bank will do nothing in the coming months until there is more clarity about the economic impact of Trump's trade policy.

Labor market: slower job growth, less pressure on wages

Just before the inflation figures were published, it seemed that the door to lower interest rates had opened a little wider again. This was due to job growth in January being weaker than expected.

Although the U.S. labor market remains tight—employers are struggling to find qualified workers—this weaker job growth has slightly reduced wage pressure. This means the risk of additional wage inflation (where rising wages drive prices even higher) has also diminished somewhat. For the Federal Reserve, this only complicates the interest rate debate further.

AI Summit: The EU Falls Behind the U.S.

During the AI Summit hosted by French President Emmanuel Macron, it once again became clear how the balance of power in the AI race is shifting. The European Union is trying to establish its own investment package for AI but is being held back by strict regulations and bureaucracy.

U.S. Vice President J.D. Vance attended the summit and emphasized that the EU must first reduce its excessive regulations and administrative burdens.

Moreover, he made it clear that the U.S. will not accept further tightening of European regulations on American tech companies. This highlights how the EU is falling further behind in the technological race, making it increasingly difficult to compete in the global AI competition.

German Economy Continues to Struggle

Germany's economic situation remains concerning. Industrial figures have once again disappointed, confirming that Europe’s largest economy is still struggling with bureaucracy, climate regulations, and international competition.