Markets on a Knife’s Edge: Trade War Rages, Yet Stocks Climb?

March 27 2025

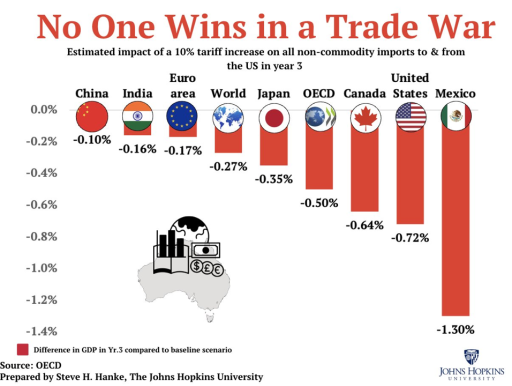

- Stock markets rise despite trade war: Equity markets react surprisingly positively to reports that Trump wants to target his import tariffs more effectively

- US consumer confidence falls: US consumers are increasingly worried about rising prices and economic prospects.

- Cautious rapprochement in Ukraine conflict: Russia, Ukraine and the US reach a tentative agreement on a possible ceasefire.

- Germany invests, Netherlands remains frugal: German companies are more optimistic thanks to billions in new investments, while the Netherlands maintains strict fiscal rules.

Stock markets up despite ongoing trade war

As in recent weeks, this week was largely dominated by US President Donald Trump's trade war. Nevertheless, the markets fared differently than before: stock markets actually went up cautiously this time.

Investors reacted positively to reports that Trump may opt for a more targeted approach in imposing import tariffs. This was interpreted as a sign that there is room for nuance, and that whole regions or countries will not simply be targeted if they do not meet US requirements.

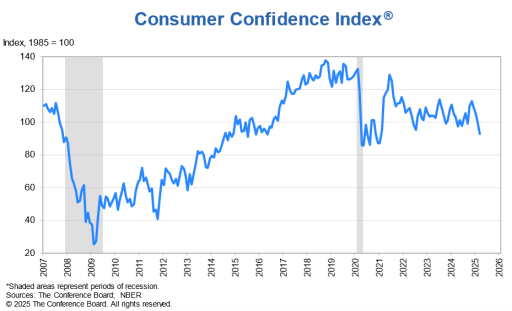

US consumer grows gloomier

US consumers are beginning to feel, or at least fear, the effects of the trade war. Levies are pushing up the prices of imported goods, driving up inflation.

Consumer confidence has now fallen to its lowest level in more than four years. And when looking at confidence in the future, Americans are even the gloomiest in 12 years.

As a result, consumption, which accounts for about two-thirds of the US economy, risks declining. That could bring a possible recession closer. At the same time, incomes are still developing favourably, which in turn helps to mitigate that risk somewhat.

Tentative step towards ceasefire in Ukraine

There was also news about the war in Ukraine. Ukraine, Russia and the United States reached a tentative agreement on a ceasefire, particularly focusing on energy infrastructure and the Black Sea.

However, Russia would like certain sanctions to be suspended in return. For now, the US has indicated that this is not an option, leaving the agreement in doubt.

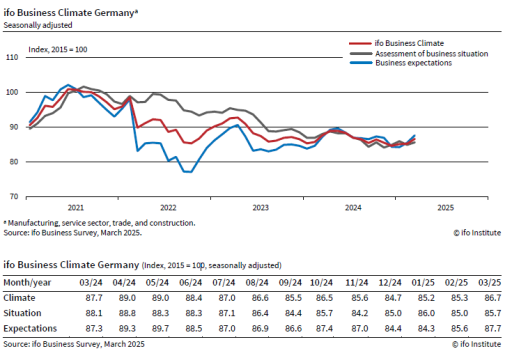

German entrepreneurs more positive due to investment plans

Business confidence rose in Germany. This was shown by the Ifo index, a leading measure of business confidence.

In particular, expectations for the future increased, probably in response to the large investment package recently approved by the German government. This involves investing tens of billions of euros in defence and infrastructure, with which it hopes to also boost the economy.

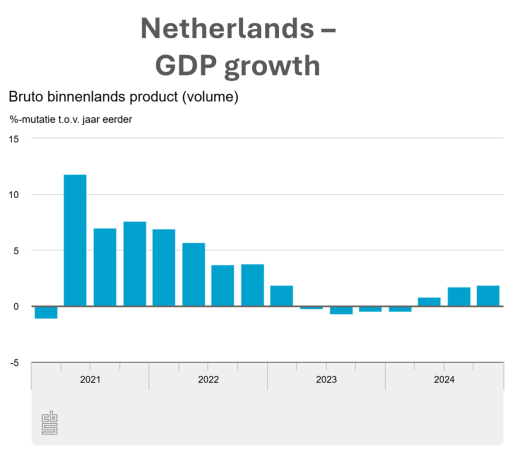

Netherlands remains frugal, growth remains limited

Finally, news from the Netherlands. The economy grew by 0.4% in the fourth quarter of 2024, bringing annual growth to 1.0%.

Now that Germany has decided to partially release the debt brake, the Netherlands is the only larger EU country still sticking strictly to tight fiscal rules. Despite having the lowest debt-to-GDP ratio of any major member state, the risk of austerity remains relatively high, especially if economic growth does not pick up.