NVIDIA loses $600 billion, Fed uncertain about inflation & Trump tackles imports

January 30 2025

- NVIDIA loses $600 billion in market value due to new AI competition from China

- Federal Reserve maintains interest rates, but inflation uncertainty remains

- Trump announces new import duties, impact on euro and trade visible

- German economy under pressure, third year in a row of possible contraction

- Netherlands considers VAT increase, impact on inflation and purchasing power

Volatile week in financial markets

Last week was particularly unsettled in the markets. This was mainly caused by the news that DeepSeek, a Chinese technology company, has developed an AI model that can compete with ChatGPT and other AI chat robots from major US tech companies.

What sets DeepSeek apart is that its model is built and trained much cheaper than those of its US competitors. This news sent shockwaves through the technology stock market, especially the NASDAQ, where many AI-related companies are listed. The VIX index, the risk measure for the US stock market, shot up sharply for a short time.

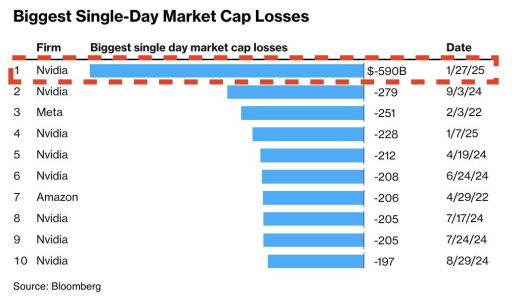

NVIDIA loses $600 billion in market value

One of the biggest victims of the DeepSeek news was NVIDIA, known for its powerful AI processors. Investors feared that companies would need fewer of these expensive processors in the future, causing NVIDIA to sell less.

The result: NVIDIA's share price fell 18% on Monday, representing a loss in market value of nearly $600 billion. That is the biggest 1-day drop in value of a listed company ever.

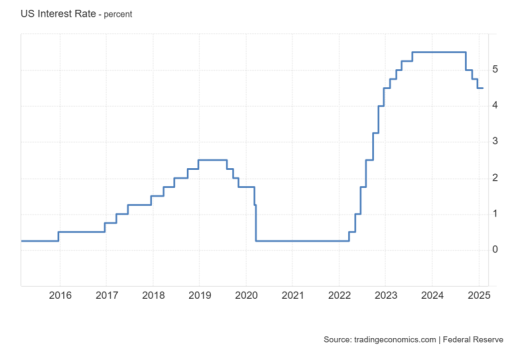

Fed leaves interest rates unchanged and waits for inflation

The Federal Reserve (Fed) kept interest rates unchanged this week, as widely expected. Nevertheless, the interest rate decision still caused more volatility in the markets.

What was particularly striking was that in its accompanying comments, the Fed deleted the sentence mentioning that inflation is moving towards the target. Previous interest rate decisions did mention this. Incidentally, Fed boss Powell nuanced this decision later in the press conference by stating that it was not meant to reflect an adjustment in policy. Nevertheless, the omission of this passage indicates that the Fed remains cautious for the time being and is not taking immediate action.

Trump pushes for new import tariffs

The price reactions to DeepSeek do not seem to have escaped President Donald Trump either. Whereas he was initially reluctant, he now wants to move faster to introduce a new round of import tariffs.

Earlier, we saw the euro rise when Trump did not yet speak out on import tariffs. Now the opposite is happening: as he wants to press ahead with his plans, the euro weakened again.

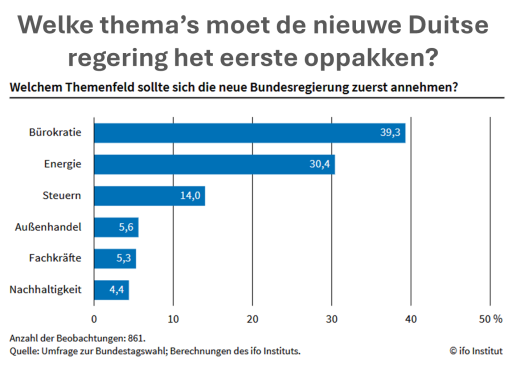

German economy under pressure

Pressure on Germany's elections in February is mounting. Large German companies have long complained about the many regulations, and this week this was confirmed by the influential advocacy organisation BDI, which expects the German economy to shrink again by 2025.

If this happens, it will mean that the German economy will shrink for the third year in a row, something that is very rare. The monthly Ifo survey, which measures sentiment among German businesses, shows that 40 per cent of companies surveyed think that the new government should cut red tape in particular. This shows that businesses are increasingly concerned about the inhibiting effect of rules and administrative burdens on the economy.

Japan raises interest rates without surprise

In Japan, the central bank raised interest rates by 0.25% to 0.50%. Unlike the previous interest rate hike, which shook the markets considerably, there was no reaction this time.

This is because the Bank of Japan had announced this move well in advance, so investors had already prepared for it. The previous interest rate hike does raise questions.

Last year, an unexpected interest rate hike raised many questions about the future of the carry trade - a strategy in which investors borrow cheap money in Japanese yen and invest it in countries with higher interest rates, such as the US. As a result of the interest rate surprise in late July 2024, the value of the yen rose sharply. This suddenly made repaying yen loans much more expensive, forcing investors to sell their positions en masse.

This time, the central bank seems to have mitigated this risk by preparing investors well and making additional interest rate hikes likely to be slow.

Netherlands: VAT increase in sight?

Although few macroeconomic figures came out of the Netherlands this week, it was still unsettled on the financial front. The State Secretary of Finance has proposed raising VAT from 21% to 21.4%. This should close a €1.2 billion budget gap.