Trade war erupts: Trump throws oil on economic fire!

April 3 2025

Trump announces historic import tariffs - New tariffs of up to 54% on goods from China, Vietnam and Japan, among others, are causing market panic.

Stock markets fall, gold rises - Uncertainty increases as trade conflict escalates.

US economy shows strength, but signs of cooling - Consumer confidence drops to lowest point in years.

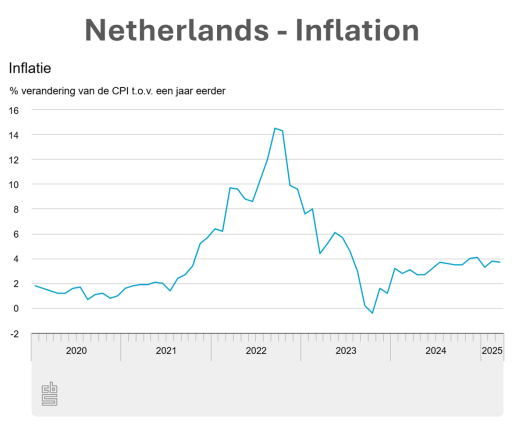

Inflation remains stubborn - Inflation remains above 3% in the Netherlands, while interest rate cuts in Europe are in doubt.

Trade war escalates

President Trump this week announced the sharpest import tariffs in more than a century. From 5 April, a minimum 10% tariff will apply to almost all goods exported to the United States, with sharply higher tariffs on some 60 countries from 9 April. With this, Trump is further escalating his trade dispute, in an attempt to address major trade imbalances with other countries. For China, this means tariffs of at least 54%, while countries like Vietnam (46%), Taiwan (32%), India (26%) and Japan (24%) will also be firmly hit. The previously announced 25% levy on car imports is now also in place.

The announcement led to turmoil in financial markets. While share prices fell, traditional safe havens such as gold rose. In his speech at the Rose Garden, Trump stressed that the new measures were needed to ‘restore American prosperity’ after decades in which other countries, he said, got richer at the expense of the US. China immediately announced retaliatory tariffs. Economists warn that these tariffs could lead to higher prices in the US, slower-growing economies worldwide, and possibly even recessions in several countries if the trade conflict continues for an extended period of time.

US economy grows, but uncertainty increases

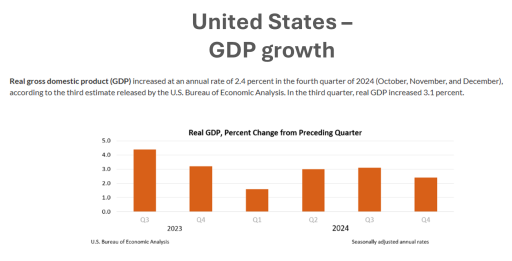

Meanwhile, the US economy's fourth-quarter growth rate for 2024 remained solid at 2.4%. Most notable was the 5.9% rise in corporate profits, the strongest increase in over two years. Consequently, the US economy started 2025 with momentum, but there are doubts about how companies will react to the trade stress that is increasingly prominent this year.

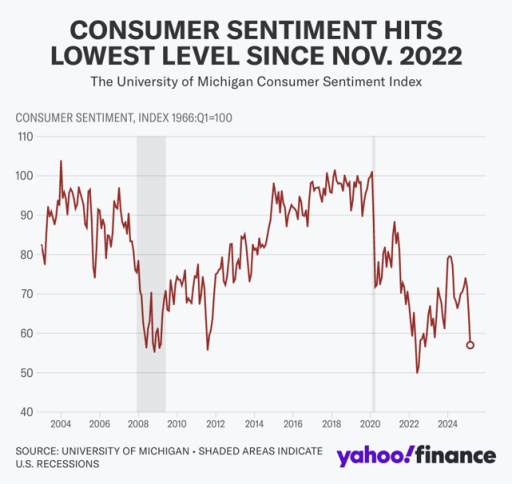

On top of this, consumer confidence dropped significantly. According to figures from the University of Michigan, sentiment reached the lowest level in over two years, while long-term inflation expectations rose to the highest level in 32 years.

Eurozone inflation falls, but less than hoped for

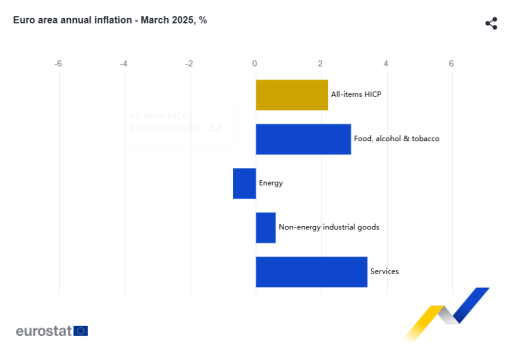

Eurozone inflation fell to 2.2% in March, a tenth lower than in February and in line with average expectations. Services inflation fell to 3.4% from 3.7%, and underlying price pressures also eased slightly.

Still, European Central Bank policymakers doubt whether further interest rate cuts are justified. There are divisions over the impact of US rates on inflation, and the ECB will also have to assess the impact of rising European defence spending and Germany's investment programme.

Markets tempered their expectations for further rate cuts. The probability of another move in April fell from 85% to 70%. The outcome of the US rate decision may be the deciding factor in this.

Dutch inflation remains stubbornly high

In the Netherlands, inflation remained virtually unchanged in March at 3.7% compared to February, when the figure stood at 3.8%.