Trump's trade war hits: inflation danger and markets on edge!

March 13 2025

Inflation remains stubborn - US inflation came in lower than expected (2.8%), but remains above the Fed target. Interest rate cuts remain uncertain.

Trump continues trade war - New import tariffs threaten to push up inflation further and put pressure on economic growth.

Uncertainty in markets - Investors remain nervous due to geopolitical tensions, sluggish economic growth and unclear Trump policies.

Gold falls in euros, stable in dollars - The strong euro is depressing gold prices in Europe, while gold in dollars remains close to its peak.

US inflation lower than expected, but investors remain concerned

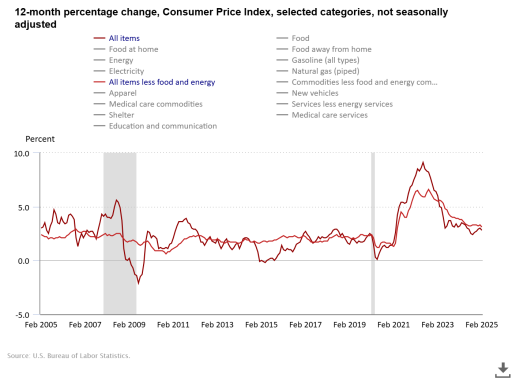

The most important economic figure this week was undoubtedly US inflation. Prices rose 2.8% in February from a year ago, slightly less than the 2.9% economists had expected. Core inflation, which excludes the volatile prices of energy and food, also came in lower than expected at 3.2%.

Despite these slightly more favourable figures, investors could find little enthusiasm for them. At almost 3%, inflation still remains well above the Federal Reserve's target. This means that interest rate cuts cannot be taken for granted for the time being.

Trump continues import tariffs, chance of higher inflation grows

Meanwhile, Trump continues unabated in announcing new import tariffs. Recent reports indicate that most countries and regions, with the exception of the UK, are considering and deciding on retaliatory tariffs. This makes it increasingly likely that inflation will pick up in the coming months, especially if companies pass on some of the higher import costs to consumers.

Investors fear that this trade war will put further pressure on economic growth.

US economy: recession or temporary cooling off?

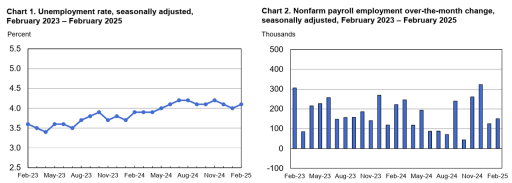

Besides concerns about inflation, investors continue to look critically at the US economy. In recent weeks, they have become more concerned about a possible recession, but hard signs of that are still missing.

Job growth is cooling, but the number of open vacancies actually increased. This creates a mixed picture, with some parts of the economy slowing down while other sectors continue to experience tightness in the labour market.

Trump seems deliberately unwilling to hurry to immediately counter any economic slowdown. His team insists that the current economic situation is due to his predecessor, and possibly Trump sees a short-term dip as an opportunity to more easily implement his own stimulus policies later.

Eurozone continues weak growth, split on defence spending

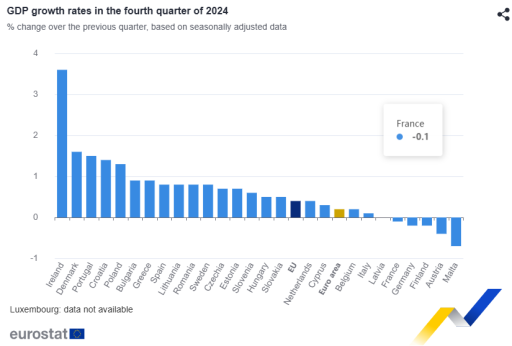

In the Eurozone, the economy grew by 0.2% in the last quarter of 2024, slightly better than previous estimates. Still, growth remains modest and the region has been experiencing slow economic progress for several quarters.

It is hoped that large-scale investment in defence and infrastructure could provide additional impetus. But it is now clear that member states are far from being on the same page on how these plans should be financed.

In the Netherlands, a narrow majority voted against Ursula von der Leyen's EU rearmament plan. The Netherlands does not like the relaxation of budget rules to enable spending, but has little influence on this at EU level.

Investors remain uncertain, markets under pressure

Stock markets also remained under pressure last week. The combination of trade wars, political uncertainty and a slowing economy made investors cautious.

In particular, the lack of transparency on Trump's exact (economic) plans and little concrete progress in the peace talks between Russia and Ukraine make investors nervous.

Until there is clarity on trade policy and geopolitical tensions, markets are likely to remain volatile.

Gold price unchanged in dollars, but down in euros

The gold price shows an ambivalent picture. In dollars, the gold price is still close to its peak, while in euros it is significantly lower.

This is due to the stronger euro, which gained ground against the US dollar again this week. Apparently, investors are more worried about the economic situation in the US than in Europe.

Still, the question remains how long this trend will last. If the US cools down economically, Europe will eventually suffer too.