Trump's trade war & Gold $3,000 an ounce

March 20 2025

- Federal Reserve keeps interest rates at 4.5% - chance of stagflation grows

- Gold price pops through $3,000 an ounce, safe haven in uncertain times

- Trade war escalates: import tariffs threaten to fuel inflation

- Germany eases debt brake, increases defence spending

Federal Reserve keeps interest rates at 4.5%, outlook worsens

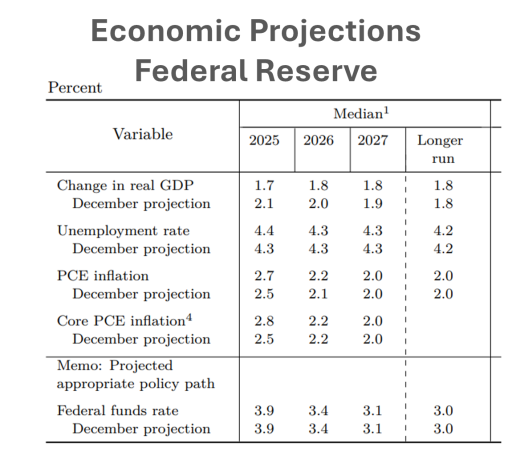

As expected, the Federal Reserve left policy rates unchanged at 4.5%. What did change was the outlook for economic growth and inflation.

The growth forecast for 2025 was lowered to 1.7%, while inflation expectations were actually raised to 2.8%. This indicates an increasing risk of stagflation, a situation where economic growth slows down but inflation remains high.

For 2025, the Fed expects two more rate cuts, but during his press conference, Fed chairman Jerome Powell warned that uncertainty about future policy has increased considerably. One of the main reasons for this is President Trump's trade war, which has an unpredictable impact on the US economy and inflation.

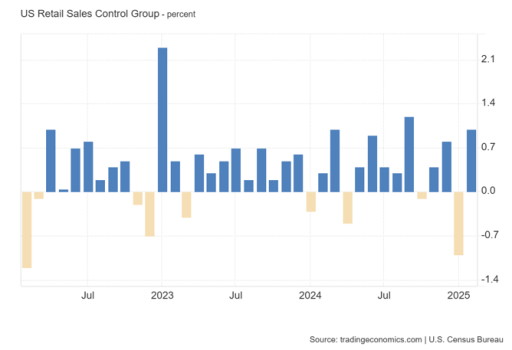

US retail sales remain strong

US retail sales rose 0.2% in February. At first glance, this seemed disappointing, as economists had expected a 0.6% rise.

However, when the figures are adjusted for volatile components such as car sales, building materials and petrol, it shows that core sales increased by 1.0%. This is a stronger figure than expected and suggests that the US consumer is still resilient.

Despite the mixed signals and growing concerns about the trade war, the US economy does not seem to be heading for a recession for now.

No ceasefire in Ukraine and Israel

President Trump tried to broker a 30-day ceasefire in Ukraine, but negotiations are struggling. After talks with Russian President Putin and later Ukrainian President Zelenskiy, no more was achieved than a temporary halt to attacks on Ukrainian energy infrastructure.

The ceasefire between Israel and Hamas also seems off the table. Disagreements over a hostage exchange caused talks to stall. The United States backed renewed Israeli attacks, again escalating the situation.

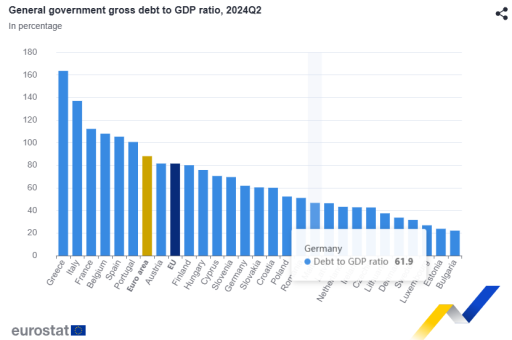

Germany increases spending and eases debt brake

Germany approved a sizeable spending package focused on defence and infrastructure. Any additional aid to Ukraine also falls under this new budget.

This means Germany is partially moving away from the debt brake, a constitutional rule that limits German government spending. The debt brake has allowed Germany to have much less debt than other European countries such as France and Italy, but at the same time has limited economic growth.

With this decision, Germany appears to be creating more financial space, in response to increased geopolitical tensions and changing European defence strategy.

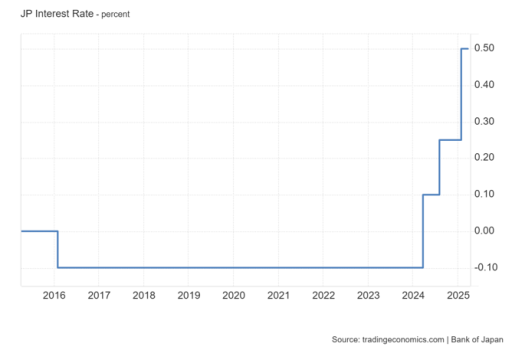

Japan's central bank leaves interest rates unchanged

The Bank of Japan (BOJ) kept its policy rate at 0.5%, as expected by economists.

In the statement, the BOJ pointed to trade policy as a risk to the economic outlook, probably referring to US import tariffs. During the press conference, Governor Ueda indicated that inflation is currently the main concern. This makes it likely that the BOJ will still raise interest rates on 1 May.

Unlike last August, when the BOJ unexpectedly raised interest rates and the yen soared, the central bank is now much more cautious in its communications. Back then, the sudden rate hike caused a sharp fall in the stock market and a crisis in the so-called carry trade - a strategy in which investors borrow money cheaply in yen to invest it elsewhere at higher returns.

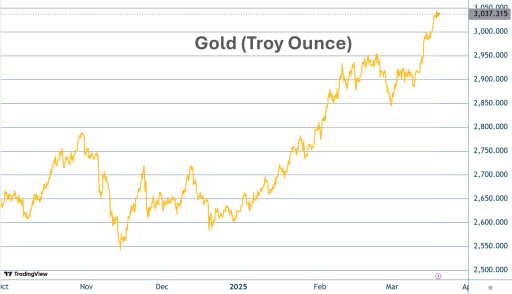

Gold breaks through $3,000 per ounce barrier

The gold price reached a new milestone. For the first time in history, the price of a troy ounce (31 grams) rose above $3,000.