Ukraine in crisis: Trump halts military aid, EU announces billion-dollar spending!

March 6 2025

*Trump suspends military aid to Ukraine, directly impacting geopolitical tensions.

*EU and Germany announce huge defence spending, with package totalling €1.3 trillion.

*Equity markets fall, while the euro rises, due to uncertainty over economic growth and rising debt.

*US economy appears to be cooling, with contraction forecast and signals of stagflation.

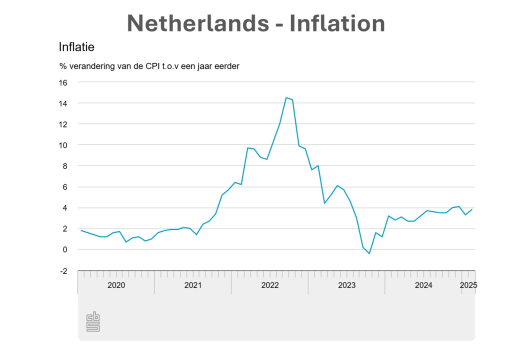

*Netherlands inflation rises to 3.8%, while water taxes rise 8% in 2025.

Tensions rise between Ukraine and US

The big news this week was the altercation between Ukrainian President Zelenskiy and US President Trump and Vice President J.D. Vance in the Oval Office. While Zelenskiy is moving closer to Trump again after a tense meeting, the US president has suspended military aid to Ukraine for the time being.

The impact was immediately felt in Europe, where uncertainty about US involvement in the conflict increased.

Europe announces huge defence spending

The heightened tensions prompted an unexpected announcement by EU president Ursula von der Leyen, who largely on her own initiative presented an €800bn defence spending package. To fund this, EU countries would be allowed to temporarily run larger budget deficits.

A day later, Germany came up with a separate €500bn package for defence and infrastructure, to be spread over the next 10 years. This could have major implications for Germany's constitutional debt brake, which may be amended to allow this spending.

These huge spending plans caused a sharp rise in interest rates in Europe. Countries with high public debt, such as France and Italy, in particular, may come under pressure as a result. European politicians will have to balance between increased defence spending and concerns about mounting debt.

UK wants to launch peace talks

Meanwhile, British Prime Minister Keir Starmer launched his own proposal to bring the parties to the table for peace talks on Ukraine. In doing so, Starmer did make it clear that he does not want to go ahead with the plan until the United States gives its approval.

Stronger euro, falling stock markets

Political developments in Europe were combined with big economic plans this week, leading to a stronger euro against the US dollar.

Still, increasing uncertainty put significant pressure on equity markets. Investors reacted nervously to the idea of governments spending big while economic growth remains uncertain.

US economic news points to slowing growth

Important economic data also came out of the United States this week.

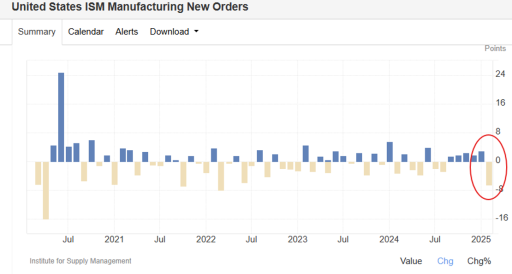

US industrial companies indicated that their prospects for new orders are deteriorating. At the same time, the prices they have to pay are rapidly rising again. This suggests that companies are still facing inflation and higher costs, posing a risk to economic growth.

In addition, investors were shocked by the so-called Nowcast growth rate from the Atlanta central bank. This model predicts how fast the economy is growing or contracting based on the latest data. Currently, the model estimates a contraction of almost 3% year-on-year, which would amount to a solid recession.

This forecast could still change as new economic data comes in, but the combination of lower growth and rising inflation - also known as stagflation - makes investors more uncertain.

Netherlands remains cautious, inflation rising

In the Netherlands, the cat is still batting an eyelid on increased defence spending for the time being. No concrete commitments have yet been made on UK peace plans or the extra defence spending NATO boss Mark Rutte is looking for. However, the Netherlands is sending more money to support Ukraine.

This increase will feed directly into inflation, putting further pressure on purchasing power.