Will September Determine the Monetary Course of the Fed and the ECB?

August 23 2017

Let us be blunt for a moment: interest rate hikes by central banks, especially the Fed, are generally bad news for precious metals. Or better said: a greater number of rate hikes than the market currently expects, mean bad news for precious metals prices. Whoever bases his or her expectations on what the Fed casually promises between lines, is assuming that the central bank based in New York will raise the official rate once more this year and another three times in the course of next year.

If this pans out to be right, then between now and New Year’s Eve 2018 we will have a total of four more rate hikes. In that case, it would not surprise if precious metals will encounter some headwinds from that direction. However, in case there will be less than four rate hikes in that period, do not be caught by surprise if precious metals continue to rally.

Now that we have established this fact: how can we reasonably assess what the Fed will do in the coming quarters? The odds are high that next month, September, will be extremely important in that regard. Here is why.

Inflation, Inflation, Inflation

The Fed kept monetary policy unchanged in July, but the central bank also made it loud and clear that future monetary policy will depend to a great extent on developments in the inflation rate and, in addition, on the performance of the labor market.

The last few months, US inflation has dropped considerably. In the beginning, the Fed was all but worried. The central bank assumed that the slowdown in inflation would be a temporary phenomenon. However, now inflation has been declining for a few months straight, the Fed is beginning to become worried. The central bank has increasingly expressed its public concern of whether there is something structurally wrong since inflation remains subdued.

THE US inflation rate has ALREADY been on the decline for some time now, Source: ST. LOUIS FED

This is important because raising interest rates while the inflation remains significantly below its two to two-and-a-half percent target and continues to be under downward pressure, does not make any sense. After all, any increase in interest rates would push inflation down even further, which is about the last thing the Fed would be wishing for.

Developments in the labor market are important because they, on the one hand, suggest what we could expect with regard to inflation in the future and, on the other hand, tell something about the state of the US economy.Jobs, Jobs, Jobs

With regard to the former: if unemployment continues to fall, then it is to be expected that there will be upward pressure on wages, because businesses must fight (compete) to hire employees. This upward pressure on wages would raise inflation.

The labor market is of utmost importance when it comes to economic growth, since an increase in employment would not only indicate that businesses are optimistic about the future of the US economy, but also that US households would have more to spend and become more optimistic themselves.

On September 1, we will hear how many new jobs have been added in August. Two weeks later, the US Bureau of Labor Statistics will announce the US inflation rate. The key question is: has the inflation rate gone up or down? The Fed will follow both indicators even more closely than usual. It is next to certain that the outcome will influence the future course of the Fed’s monetary considerably. Therefore, it is important to pay close attention to these figures in September, beginning on September 1.

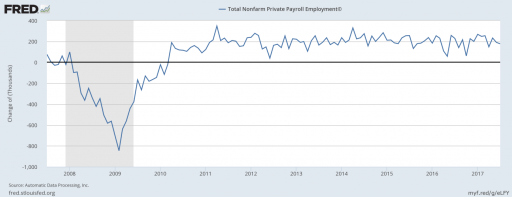

THE US LABOR market is strong, WILL it REMAIN STRONG IN THE NEAR FUTURE? SOURCE: ST. LOUIS FED

Meanwhile in the Eurozone …

A clearly less important factor for the precious metals market, but still an important factor, is the policy course of the European Central Bank (ECB). Just like the Fed, the ECB also kept its monetary policy unchanged in July. But similar to the Fed, the ECB also seems to face an important dilemma as soon as in September.

In the Eurozone, September is an important month mostly because the ECB economists will publish their new estimates on the Eurozone inflation rate for 2018 and 2019. Precisely these estimates carry great weight in practice, as the ECB board heavily relies on them for their interest rate decisions.

If these forecasts will reveal that inflation could move further away from the ECB´s two percent target inflation rate until as far into the future as 2019, then we can expect the ECB to, on the one side, taper its large-scale purchases of government and corporate bonds even more gradually and, on the other side, that the first interest rate increase in the Eurozone will be postponed even further into the future.

Considering all the above, September could be either a very volatile month for precious metals or serve as a trigger for a rally to new heights. In two weeks, we will know more.