How Much Gold Is on the Gold Market?

An analysis of global gold reserves and production

How Much Gold Is on the Gold Market?

WWW.GOLD.ORG/GOLDHUB/DATA/HOW-MUCH-GOLD

Total gold reserves

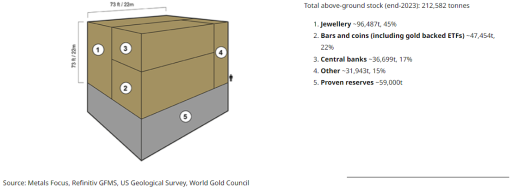

According to the World Gold Council, about 201,296 tonnes of gold have been mined in history up to the end of 2022. This gold is present in various forms: as jewellery, as private investments, as central bank reserves and in industrial applications. Most of this gold, about 92,947 tonnes, is incorporated in jewellery. The rest is divided between private investments (40,596 tonnes), official sector (central bank reserves) (34,923 tonnes), and other categories such as industry and technology (29,045 tonnes).

Annual Production

Supply and Demand

The demand for gold is driven by four key sectors: jewelry, technology, investments, and central banks. The jewelry market remains the largest consumer, but investments in gold, such as coins and gold bars, are also significantly increasing, especially in times of economic uncertainty. Central banks continue to purchase gold as part of their reserves to ensure diversification and security.

The percentages have undergone interesting changes over the years. Below is a table with the percentages of how above-ground gold was used in 2016 and 2024:

|

Category |

2016 |

2024 |

Difference (% point) |

| Jewellery |

60% |

45% |

-15% |

|

Bars & Coins |

20% |

22% |

+2% |

|

Central banks |

10% |

17% |

+7% |

|

Other (tech, etc.) |

10% |

15% |

+5% |

In eight years, the percentage of gold used for jewelry has decreased by 15 percentage points. At the same time, the share for bars and coins has increased by 2 percentage points, and for central banks by 7 percentage points, which is nearly a doubling compared to 2016.

The trend I see is that people are increasingly buying gold as an investment or as a store of value (like central banks) and less for jewelry. This may be partly because the rising gold price makes gold jewelry less accessible to a wider audience. On the other hand, private investors, central banks, and institutional parties are increasingly recognizing the value and strength of gold as a stable investment.

At GoldRepublic, you don’t buy gold because it’s beautiful, but because it is a proven stable investment that preserves your purchasing power (since currencies lose value). You purchase this centuries-old product as insurance and to strengthen your financial resilience through diversification.

Where will we be in a few years? Sign up for our newsletter (at the bottom of this page) to stay informed about interesting news that affects your investment in precious metals.

Economic Impact

Conclusion

Gold remains an essential part of the global economy and serves as a reliable investment for both private investors and governments. With a total supply of over 201,000 tons and consistent annual production, gold continues to be a valuable and stable commodity in an ever-changing financial world.